Accounting info. Closing the month in accounting

In step-by-step instructions, we will look at how in 1C Accounting 8.3 accounting for finished products and costs for them is carried out.

Before you start accounting for finished products, you need to make some preliminary settings. First of all, let's expand the functionality of the program. This can be done by clicking on the hyperlink of the same name in the “Main” section.

In the window that opens, on the “Production” tab, you need to check the box, as shown in the figure below. Otherwise, the production and release processes will not be taken into account in the program.

You most likely noticed that in our picture the “Production” flag is checked, but is not editable. This happened because the program already has documents within this functionality. To view a list of them, follow the “Production” hyperlink below.

The program generated a report for us with a list of all documents in the program that relate to production processes and product output. It is their existence that will not allow this functionality to be disabled.

The next important setting is to take into account deviations from the planned cost. When the flag is set, these deviations will be reflected in the 40th count. At the end of the month, an adjustment will be made by a special assistant to close it, and the products released will be assigned to account 43.

If you do not use such an add-on, the product release will be immediately attributed to account 43. Next, we will look at accounting reflection for both program setup options.

SOE accounting operations

Taking into account deviations from the planned cost

To reflect in the program the release of the GP produced by our organization, use the document “”. You can find it in the “Production” section.

First, we indicate all the document header data. In our example, the organization Confetprom LLC produced a certain product that was placed in the main warehouse. By default the accounting account will be 20.01.

On the “Products” tab, a list of state enterprises for which you want to reflect the release is indicated. In this example, we produced one thousand kilograms of Assorted sweets and five hundred kilograms of Cherry in Cognac. The document indicates planned prices, accounting account 43, product group and specification. The program fills in some of this data on its own.

If the finished product has a specification, then the “Materials” tab can also be filled in automatically, which greatly simplifies the work.

Please note that our candies are set to the “Products” nomenclature type, since they are a state-of-the-art product we produce.

In the situation we are considering, deviations from the planned cost are not taken into account. This is reflected in the accounting policies by the absence of the flag of the same name.

In this case, when conducting a production report for a shift, the “Assorted” and “Cherry in Cognac” candies will immediately be reflected on account 43, as shown in the image below. With this setting of accounting policy 40, the account for production output will not be used.

The sale of GP is reflected in the document “Sales (acts, invoices)”.

Closing the month

Let's move on to the end of October 2017, since that is when the release of our sweets was reflected.

In the routine operation to close accounts 20, 23, 25, 26, an adjustment was made to the output of products, namely our produced candies. As you can see in the image below, the adjustment was reflected immediately in account 43.

You can immediately generate from processing the month end. In our example, only the “Assorted” and “Cherry in Cognac” candies were included.

From this assistant you can generate other useful certificates and calculations.

Without taking into account deviations from the planned cost

Now let’s go back to the accounting policy of Confetprom LLC and set the flag in the item “Deviations from the planned cost are taken into account.” Now, when releasing a GP, score 40 will be used.

Let's check this by rerunning the previously created shift production report. In the formed movements, we see that the candies “Assorted” and “Cherry in Cognac” passed instead of Kt 20.01 to Kt 40.

At the end of the month, when closing accounts 20, 23, 25, 26, the generated movements when using the setting for the need to take into account deviations from the planned cost will differ from the previous example. Adjusting output will first create movements from 20.01 to 40 counts and only after that from 40 to 43 counts.

"operations for accounting of finished products were available, the program should be configured accordingly.

In the functionality settings (section “Main” – Settings – Functionality) on the “Production” tab there should be a “Production” checkbox:

In addition, you need to correctly: in the form for setting it up on the “Costs” tab, indicate production as a type of activity, the costs of which are accounted for on account 20 (Main production):

Here you can also set up product accounting. By default, the program takes into account manufactured products at their planned cost in accounting account 43 (Finished products), then during period closure it is produced and the amount is adjusted.

If the accountant wants to use accounting account 40 (Release of finished products), then in the accounting policy form, click the “Advanced” button on the “Costs” tab and check the box “Take into account deviations from the planned cost.” Then the manufactured products will be accounted for at the planned cost on account 40, and then, when closing the period, the program will calculate the actual cost and take it into account at account 43.

Finished products in 1C with examples

Standard documents in 1C 8.3 for reflecting production operations are available in the “Production” section (see the “Product Release” subsection).

Product output is reflected in the “Shift Production Report”. Despite the name, this program object is not a report, but a standard document.

It is first necessary to enter the manufactured products into the directory “”, indicating the type of nomenclature for them - Products. If an organization uses different ones to record its activities, you must also fill out the “Nomenclature group” field (by selecting an item from the directory).

Get 267 video lessons on 1C for free:

An example of accounting for finished products in 1C without account 40

Example 1. A furniture factory produced “Director” tables and “Clerk” tables. The accounting policy prescribes accounting for manufactured products on account 43, without account 40.

- Output. In order to reflect the release, we will create a standard document “”. In the “header” details we will indicate the warehouse (if the organization maintains warehouse records) and the cost account. On the “Products” tab, in the rows of the table, we indicate the manufactured products and manually enter their planned price. By default, the accounting account is filled in - 43.

Document 1C will generate accounting entries for accounts Dt 43 Kt 20 for the amount of the planned cost of production.

- Sales of finished products. Registered in the program in a standard way using the standard document “”.

- Closing the month and adjusting costs. At the end of the period (month), we will perform routine automatic processing “” in the program. It will calculate the cost of production based on the amount of actual costs posted to the debit of account 20 for the item group of products (if item groups are not used, costs are calculated as a whole for account 20). Costs usually include the cost of raw materials, wages of production workers, etc. Then the program will adjust the cost of production. To view the postings of this operation, you need to click on the link “Closing accounts 20, 23, 25, 26” in the month closing form and select “Show postings”:

We see that in 1C an accounting entry has been generated that adjusts the cost of production: Dt 43 Kt 20. Moreover, the amount of the entry can be negative, depending on which cost is greater - planned or actual.

If the manufactured products were sold, then during the closing of the period the program also adjusts the cost of its write-off, creating a debit entry in accounting account 90.02 “Cost of sales”:

The program allows you to generate convenient analytical reports and calculations “Calculation of cost” and “Cost of manufactured products”. They are also available in the month closing form (after the closing has been completed) using the link “Closing accounts 20, 23, 25, 26”.

The “Cost Cost Calculation” reflects the costs incurred for each unit of production:

Another calculation certificate - “Cost of manufactured products” - shows the value of the actual cost, the planned one, as well as the deviation of the “fact” from the “plan”:

Example of product accounting with a score of 40

Example 2. A furniture factory produced “Director” tables and “Clerk” tables. The accounting policy of the enterprise prescribes the use of accounting account 40 “Release of finished products”.

In the program, you need to configure the use of account 40 in the accounting policy (see the beginning of the article).

As part of the instructions on how to close account 20, as well as other cost accounts - 23, 25, 26 in 1C: Accounting 8.3, it should immediately be noted that when checking this operation at the end of the month, the balances on accounts 25 and 26 * at the end there should not be a month; on 20 and 23, on the contrary, there may be a balance for the amount of work in progress, work or services.

*In tax accounting, until December 31, account 26 can be closed with a balance for standardized expenses (for example, advertising expenses).

From the point of view of the cost of goods produced, all expenses are classified as direct or indirect*. The first of them can, without a doubt, be included in the production process of specific types of goods, that is, they can be consumables, salaries of key production personnel, etc. The accounts of such expenses can be viewed in the “Nomenclature group” section, but indirect ones cannot be, because they cannot be attributed to the initial cost of a certain type of product. They are usually attributed, for example, to administrative expenses, payment for the work of the administrative and managerial level, etc.

*This distinction is typical primarily for the accounting of industrial companies.

Closing cost accounts at the end of the month

Closing the 25th account, as well as 20, 23 and 26, is carried out through the corresponding regulated operation, which is located in the section “Operations/Period Closing/Month Closing” or “Operations/Period Closing/Routine Operations”.

Displaying both types of expenses in accounting

The table “Settings for reflecting and writing off expenses in accounting” (below) contains settings for both types of expenses in accounting, which are located in the “Main/Accounting policies” section.

Commercial structures whose business is based on services to manufacturers check the box next to “Performance of work/provision of services...”, to configure “Costs are written off” according to one of the options:

- "Excluding revenue": from Kt 20 to Dt 90.02, i.e. even if there is no turnover on account 90.01.

- “Including all revenue”: from Kt 20 to Dt account 90.02 in the context of the item groupings for which it was.

- “Including revenue from production services only”: can be written off after registration of the issue through an act of services performed.

Manufacturers themselves must mark for execution "Output".

After these steps, a set of switches will become available “General business expenses are included”:

Thus, indirect expenses from Kt 26 will be written off to Dt of direct accounts - 20 or 23 (in the second case, at the end of the month, additional expenses will be automatically written off to Dt 20, and then from Kt 20 to 40 or 43).

If account 25 is used to display indirect expenses in a manufacturing company, then you need to establish a rule for posting them on direct accounts using the link to the posting methods discussed above. According to the accounting methodology, from 25 they are posted to Dt 20 or 23. Similarly, in the case of distribution to 23, at the end of the month the costs will automatically be written off to Dt 20, and then closed at 40 or 43.

That is, when closing the month, indirect expenses are first written off from Kt 26 to Dt 90.08 (in case of write-off using the direct costing method) or from Kt 26 to Dt 20 or 23 (according to the posting rules, if any have been established). Costs from 25 will be written off in Dt 20 or 23 according to the redistribution rules. Direct items are written off by item groups to cost.

Expenses in tax accounting

The list of direct expenses attributed to production is in the section “Main/Accounting policies/Setting up taxes and reports/Income tax/List of direct expenses.”

Expenses not listed among direct expenses will be considered indirect in tax accounting and will be written off on 90.08, and direct expenses will be written off on 40.

Manufacturing enterprises that have chosen for their main activity the direct production of finished products or semi-finished products are faced with the task of reflecting and registering such business processes in regulated accounting. In this article, we offer step-by-step instructions for accounting for production and release of finished products 1C 8.3 using the “1C: Enterprise Accounting, edition 3.0” configuration.

Step 1: Check production functionality

To begin with, let’s make sure that our configuration allows us to keep track of the release of finished products in 1C 8.3.

In “Administration” in the settings, click on the “Functionality” link.

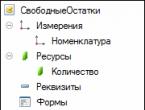

We are interested in the functionality of the production accounting system, which can be found on the corresponding tab.

We see that in this part the functions are used and cannot be turned off. At this point we consider the first step completed.

Step 2: set up accounting policy

The setting is also implemented in the main menu of the system from the “Main” section, subsection “Settings”, hyperlink “Accounting Policy”.

The accounting policy is configured for a specific organization, then we pay attention to the types of activities for account 20 and set the flag for accounting for the release of goods.

Note! At the bottom of the figure there are three additional options that also affect our accounting method:

- Accounting for deviations - turning on this flag means using account 40 “Output of products (works, services)” in accounting;

- In terms of semi-finished products, turning on this flag means taking into account multi-process production and requires setting the sequence of processing stages;

- Services to own departments – turning on this flag means accounting for counter output, and requires setting up the “Counter Issue” register to prevent looping in the calculation of the cost of goods.

We are considering an option without using count 40, counter issues and semi-finished products.

This step is complete, we have completed the necessary policy settings.

Step 3: register issues at planned cost

In the main menu of the system, the “Production” section is responsible for recording production processes, and a separate subsection is directly devoted to production.

- Request invoice – allows you to register the transfer of materials to production or any other write-off of them as costs. The release can be registered without it, but this depends on the setup of the production business process;

- Production report for a shift - registers production according to planned production and at the same time write off materials for production.

Let's analyze in detail the work with the production report for the shift.

Let's create a new document and fill it out taking into account the release of one type of goods according to a simple production specification.

In the header, in addition to the name of the company and the warehouse where the material is taken from and where the released goods are placed, you will need to indicate the cost account and the production cost division.

To fill out the tabular part, the system must include indicators in the nomenclature directory, which will contain information about the varieties of manufactured goods.

The item card must have the form “Products”. For separate accounting on the cost account of the main production, it is necessary to fill out an item group. To automatically write off materials for manufactured products, you need to fill out a specification, which can be created directly from this card.

Our next action is to enter in the “Products” plate, the quantity of production, put down the planned price, specification. The lines “Account” and “Item group” will be filled in automatically according to the item card data.

To write off materials and add them to the s/s composition, fill out the “Materials” tab. If there is a specification, filling will occur automatically by clicking the “Fill” button.

This accounting step should be completed by completing the created form. The transactions generated by this reflect the accounting of production and release of finished products in 1C 8.3.

Analyzing the postings, we see that the credit of account 20 reflects the planned cost, and the debit of account 20 collects actual costs. To make a correct calculation, you need to understand the actual cost of finished goods.

Step 4: calculate the actual cost of production

Before calculating the actual cost, the system must reflect all necessary costs in the main production account. In addition to raw materials, this may include workers’ salaries, equipment depreciation, and other expenses. This calculation is triggered through Monthly Closing.

The current calculation is possible if the calculations of previous periods have been completed.

If the period is closed without errors, then all operations are reflected in green. To check the cost calculation, let's look at what transactions were generated when closing cost accounts. To do this, select the appropriate operation “Show transactions”.

The calculation made an adjustment to the output, this is reflected in the first posting. The posting creates a reversal entry, because The planned cost turned out to be more than the actual costs.

Step 5: analyze reports on the actual cost of goods

Finally, we just need to make accounting reports for cost accounts and finished goods. Previously, in our example, we did not reflect work in progress, assuming that all products were released to the warehouse and there were no unprocessed raw materials left in the workshops of the enterprise. This means that the balance of the main production account should be zero, and the actual cost of production was formed in the finished goods account.

We see that account 20 is closed.

The calculation was made correctly. The next stage will be accounting for the sale of finished products in 1C 8.3.

Starting from 2013, all organizations (including organizations using the simplified tax system and UTII) are required to keep accounting, draw up and submit to the tax authorities and ROSSTAT a legal copy of the financial statements for 2018: balance sheet and financial results statement.

The balance sheet of a small enterprise must be submitted in two addresses, places. The obligation to submit a mandatory copy of the accounting (financial) statements to the state statistics body (Rosstat) at the place of state registration arises in accordance with the accounting law 402-FZ.

But the second copy of the financial statements - the balance sheet and the financial results statement must be submitted to the tax office - the Federal Tax Service of the Russian Federation. This duty arises in accordance with. Where does it say in clause 5 clause 1 that the taxpayer is obliged to submit to the tax authority at the location of the organization annual accounting (financial) statements no later than three months after the end of the reporting year.

Note: Except for cases when an organization, in accordance with Federal Law of December 6, 2011 No. “On Accounting,” is not required to keep accounting records. These include, in particular, individual entrepreneurs.

Before preparing financial statements for the year, the accountant needs to summarize the organization’s activities and close the accounting accounts, according to which the financial results of the organization’s activities are determined.

In work it is also necessary to be guided, provisions of the Tax Code of the Russian Federation and data from tax registers of the organization.

to menu

How to close reporting periods in accounting and determine financial results during the year

It is clear that this is an unusual and difficult task for beginners, so we will briefly and in an accessible form describe this process.

To determine the financial result of an organization’s activities, it is necessary to close the reporting period. In accounting, a month is recognized as a reporting period (clause 48 of PBU 4/99).

All accounts related to the display of production costs, revenue (income), and the formation of financial results for compiling the balance sheet of a small enterprise can be conditionally divided into three groups:

1 . Accounts that, in accordance with Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n “On approval of the Chart of Accounts for accounting of financial and economic activities of organizations and instructions for its application,” do not have a balance at the end of the month - 25 “General operating expenses” 26 “ General running costs".

2 . Accounts that, in most cases, have a balance of work in progress, but can be completely closed (20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities”)

3. Accounts that generally do not have a balance at the end of the month, but have a balance for each subaccount - 90 “Sales”, 91 “Other income and expenses”.

to menu

Writing off costs to expense accounts

Write-off of expenses on account 26 “General business expenses”

The procedure for closing account 26 depends on the chosen accounting policy, or more precisely, the method of forming the cost of production.

The cost price can be formed: 1) at the full production cost; or 2) at reduced production costs.

Note: For small businesses, the second option is more convenient.

When choosing an accounting policy " at full production cost» costs can be written off monthly using the following entries:

Debit 20 “Main production” Credit 26

Debit 23 “Auxiliary production” Credit 26

Debit 29 “Service production and facilities” Credit 26

When choosing an accounting policy " at reduced production costs» General business expenses can be fully attributed to the cost price:

D 90.2 “Cost of sales” Credit 26.

Write-off of expenses on account 25 “General production expenses”

Account 25 is closed monthly by debiting the amount of expenses from the account using the following transactions:

Debit 20 “Main production” Credit 25

Debit 23 “Auxiliary production” Credit 25

Debit 29 “Service production and facilities” Credit 25

depending on the activity with which these costs are associated.

Writing off costs from account 44 “Sales expenses”

Costs are written off from account 44 “Sales expenses” monthly in whole or in part by posting:

Debit 90.2 “Cost of sales” Credit 44 – sales expenses are written off.

Closing account 20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities”

At the end of the month, accounts 20,23,29 can be closed with the following transactions:

Debit 90.2 “Cost of sales” Credit 20

Debit 90.2 “Cost of sales” Credit 23

Debit 90.2 “Cost of sales” Credit 29

Service organizations can close these accounts completely (without leaving unfinished production on the account balance).

to menu

Closing accounts 90 “Sales” and 91 “Other income and expenses”

At the end of each month, organizations determine the financial result of their activities (profit or loss).

The financial result of the organization’s activities is determined as follows:

The amount of the organization's revenue (Turnover on Credit account 90.1) minus Cost of sales (amount of turnover on accounts 90.2, 90.3,90.4,90.5).

If the difference between Revenue (minus VAT and other similar payments) and Cost is positive, then the organization made a profit in the reporting month.

The amount of profit is reflected by the posting:

Debit 90.9 Credit 99 – profit for the month is reflected.

If the difference is negative, then the organization suffered a loss.

The amount of loss is reflected by the posting:

Debit 99 Credit 90.9 – reflects the loss at the end of the month.

Thus, the subaccounts of account 90 “Sales” have a balance at the end of each reporting month, but account 90 itself should not have a balance at the end of the month.

At the end of the year, all subaccounts of account 90 that have a balance must be closed.

Subaccounts are closed using the following transactions:

D 90.1 K 90.9 – closing of account 90.1 “Revenue” at the end of the year.

D 90.9 K 90.2 – closing account 90.2 “Cost of sales” at the end of the year.

D 90.9 K 90.3 – closing of account 90.3 “Value added tax” at the end of the year.

D 90.9 K 90.4 – closing of account 90.4 “Excise taxes” at the end of the year.

D 90.9 K 90.5 – closing of account 90.5 “Export duties” at the end of the year.

Closing account 91 “Other income and expenses”

At the end of each month, organizations determine the financial result in account 91 “Other income and expenses.”

The balance of other income and expenses is the difference between the turnover on the Credit of account 91.1 “Other income” and the turnover on the Debit of account 91.2 “Other expenses”. If the account balance is in credit, the organization has made a profit, and if the account has a debit balance, the organization has made a loss.

The financial result for other income and expenses is reflected in the following entries:

Debit 91.9 Credit 99 - profit from other activities is reflected;

Debit 99 Credit 91.9 - loss from other activities is reflected;

At the end of the year, all subaccounts of account 91 are closed with the following transactions:

Debit 91.1 Credit 91.9 - subaccount 91.1 is closed at the end of the year.

Debit 91.9 Credit 91.2 - subaccount 91.2 is closed at the end of the year.

to menu

Closing account 99 “Profits and losses” at the end of the year

If at the end of the year the organization made a profit, then the following posting is generated:

Debit 99 Credit 84 - reflects the net profit of the reporting year.

if there is a loss, then the posting:

Debit 84 Credit 99 - reflects the uncovered loss of the reporting year.

to menu

A simple form of accounting for micro-enterprises

The right to keep records for groups of financial statements items without using double entry in accounts.

The easiest way to organize accounting is do not use double entry at all, that is, do not make any postings at all. True, only micro-enterprises can use this method (clause 6.1 of PBU 1/2008). And only if it does not distort information about the company, that is, it allows the preparation of financial statements.

The article will help you draw up a balance sheet; balances and turnovers are considered in detail, for which accounts the Balance Sheet and the Statement of Financial Results for small businesses are compiled (Form KND 0710098). Download balance sheet and financial statements forms. Simplified accounting reporting for small businesses. Download Taxpayer program version 4.45.2

Reporting via the Internet. Contour.Extern

Federal Tax Service, Pension Fund of Russia, Social Insurance Fund, Rosstat, RAR, RPN. The service does not require installation or updating - reporting forms are always up to date, and the built-in check will ensure that the report is submitted the first time. Send reports to the Federal Tax Service directly from 1C!