Accounting info. Accounting for defective goods, products, materials in "1C: Accounting" 1C retail does not write off goods from the warehouse

Every organization periodically faces a situation when it is necessary to write off a product due to damage, non-repairability, for business or office needs. It also often happens that during the inventory the goods are not found. The actions will be similar.

Write-offs can be made in two ways:

- Based on inventory - automatically.

- A separate document - manually.

In each case, a “Write-off of goods” is created, the only difference is in the process. When preparing a separate document, filling out is carried out manually, and based on the inventory, all data is transferred automatically. Let's first create the document “Inventory of goods”. Based on it, it is possible to create two documents:

- Posting of goods.

Go to the “Warehouse” menu tab and select the “Goods Inventory” item. Press the “Create” button. An empty form opens:

Filling can be done by warehouse or by the person in charge. For example, let's choose a warehouse. Now you need to add a product. This can be done through the “Add” button by selecting each item separately. This method is used only when you need to account for a small quantity of goods. If the inventory is carried out for all the goods that are in the warehouse, then to do this, press the “Fill” button and select the “Fill according to warehouse balances” item. The program will enter into the document the entire number of product units that are listed in the selected warehouse. Pay attention to the display of the number in the columns “Actual Quantity” and “Accounting Quantity”. They are equal. And in the “Deviation” column nothing is indicated, that is, it is zero:

This document must be recorded, printed and sent to the warehouse to calculate the actual number of product units. Let's say it turns out that there is less of one product than is listed in the program, and more of another. The correct data is entered manually in the “Actual Quantity” column. And the deviation is immediately displayed:

For proper registration, you need to fill out the remaining two tabs in the document: “Inventory” and “Inventory commission”. We carry it out. The purpose of inventory is to align the balances of goods that are in the warehouse with the balances that are listed in the program. Therefore, it is necessary to create two documents - capitalization of unaccounted goods and write-off of missing goods. Let's focus on write-offs. This action is carried out through the “Create based on” button. Click and select the item “Write-off of goods”. The completed document form opens:

There is no need to change anything here, click “Pass and close”. Now let's look at the wiring:

You can see that the goods were previously listed on the credit account 41.01 (Goods in warehouses) and were written off to debit account 94. A similar posting in cloud 1C would have been formed when a separate document “Write-off of goods” was generated (manually). In this case, you would have to enter all the data yourself.

If the inventory of goods reveals a shortage, then such property must be written off. The main reasons for the shortage are theft, damage and mis-grading. Regardless of the reason, the shortage in 1C 8.3 is written off from the credit of the goods accounting account to the debit of account 94 “Shortages and losses from damage to valuables.” Write-off of goods in 1C 8.3 can be done in two ways. See step-by-step instructions.

The fact of shortage or damage to goods can be established by inventory. To carry it out, you need an order from the director, which sets the timing, location and composition of the inventory commission. .

Based on the results of the inventory, a write-off act is drawn up. In 1C 8.3 such an act can be done in two ways:

- create manually;

- create based on inventory data.

The second method is more convenient and faster, since when you use it, 1C 8.3 will fill out the report automatically based on the shortages identified during the inventory. Let's talk about how to write off goods in 1C 8.3 in two ways. In each of them you need to go through several steps.

Creating a write-off report manually

Step 1. Open the write-off act in 1C 8.3

Go to the “Warehouse” section (1) and click on the “Write-off of goods” link (2). A window will open for creating a statement of write-off of goods.

Step 2. Fill out the basic details of the act

In the window that opens, click the “Create” button (3). In 1C 8.3, a form will open for creating an act of writing off goods.

In the title of the form, indicate your organization (4), the write-off date (5), and the warehouse (6) from which you want to write off the goods in 1C 8.3.

Step 3. Enter product information in 1C 8.3

In the “Products” tab (7), click the “Selection” button (8). The “Item Selection” window will open to select the product to be written off.

In the item selection window, click on the item to be written off (9). In the form that opens, indicate its quantity (10) and click “OK” (11). In the same way, select the remaining goods for write-off in 1C 8.3. After this, all the products you have selected will appear in the “Selected Items” section (12).

To complete the operation, click on the “Move to document” button (13). After this, all selected items will be included in the write-off report.

Step 4. Save the act and make write-off entries in 1C 8.3

The write-off report is completely completed, all that remains is to record the write-off of the goods in the accounting registers 1C 8.3. To do this, click “Record” (14) and “Pass” (15). Accounting entries can be viewed by clicking on the “DtKt” button (16).

In the accounting entries we see that the material assets reflected in the write-off act (17) are written off to the debit of account 94 “Shortages and losses from damage to valuables” (18).

Close the posting window using the “Record and close” button and proceed to the next step.

Step 5. Print the write-off act from 1C 8.3

To document the write-off of the shortage, you need to draw up a write-off act in the “TORG-16” form. To print the act using this form, click the “Print” button (19) and click on the link “Act on write-off of goods (TORG-16)” (20). A printed form of the act will open on the screen.

In the printed form, click the “Print” button (21).

Don’t forget to sign the printed report from all members of the inventory commission.

Creating a write-off act based on inventory

When taking inventory of goods, the 1C 8.3 program records the deviation between the accounting and actual quantities of goods in the warehouse on a given date.

If the inventory was carried out and documented in 1C 8.3, then based on its data, a write-off can be issued. How to write off goods in 1C 8.3 based on inventory? This can be done in 3 steps.

Step 1. Create an act for writing goods based on inventory data

Go to the “Warehouse” section (1) and click on the “Goods Inventory” link (2). A list of all inventory operations that you have carried out before will open.

Step 2. Open an act for writing off goods in 1C 8.3

In the general list of results of previously conducted inventories, find the one you need, within the framework of which the goods will be written off. Select it with the mouse (3). Next, click on the “Create based on” button (4) and click on the “Write-off of goods” link (5). The completed form of the act for write-off of goods will open.

Step 3. Enter information about the product into the act

In the write-off act, check whether the data from the inventory was transferred correctly and click the “Record” (6) and “Post” (7) buttons.

Now you can print the write-off act. How to do this is written in step 2 of the section “Creating a write-off report manually.”

Selection of materials for write-off in 1C: Accounting (8.3, 8.2, editions 3.0 and 2.0)

2016-12-07T17:06:05+00:00Often accountants need to write off materials through a demand invoice for a certain amount or even write off all available materials.

This processing allows you to easily and clearly select the required amount of the required materials, which are left as a balance on the required account (for example, 10.1). The treatment is suitable for both “two” and “three”.

I'll show you with an example.

Open processing. We select the organization on which we will write off the day and the account from which we will write off the materials.

Click the "Fill" button:

Processing automatically filled out the tabular part for us with account balances 10.1 broken down by warehouses as of September 4 for our organization:

Now, right in the tabular part, we remove unnecessary materials (using the “Delete” button or the “Delete” key) and adjust the amount of remaining ones, if necessary.

Then click the “Create invoice request” button - a “Request invoice” document will be automatically created, already filled in with our data. It turns out very convenient.

Here is the processing itself (separate for “three” and “two”):

Download for three

Important#1! If an error occurs when opening processing " Access Violation" - about what needs to be done. Important#2! Whenever any other error after opening or during processing - follow.

Healthy!

Download for two

Healthy!Sincerely, Vladimir Milkin(teacher and developer).

How to properly write off goods in 1C 8.3 Accounting 3.0?

Goods are written off in two ways:

- when a shortage is discovered during inventory, and it is necessary to remove the required inventory from the balances

- directly by the document “Write-off of goods”

In any of these cases, a document “Write-off of goods” is created. Only in the first case it is created automatically from the inventory list, and in the second case manually (for example, in case of obvious damage to the material).

Let's consider the write-off process by first creating the “Inventory of goods” document, since this option also includes manual creation of a write-off document.

It must be said right away that the document “Inventory of goods” itself does not make any entries. Based on it, two documents are created:

- Posting of goods

- Write-off of goods

Creating a document “Inventory of goods”

Let's create a document “Inventory of goods”. Go to the “Warehouse” menu, then click on the “Goods Inventory” link. In the list form, click “Create”. You should see something like this:

You can add positions one by one using the “Add” button, or you can use the fill button. In this case, the program will prompt us to fill out the document with the balances in the warehouse (those listed in the system). Initially, the “Actual Quantity” column will contain the same number as the “Accounting Quantity” column.

The deviation is accordingly equal to zero by default:

Now let’s assume that we went to the warehouse, counted our goods, and discovered that for some reason we were short of the product “GVP panel steel 495x195 diodes 2 baguettes” in the amount of two pieces.

The responsible persons together with the storekeeper will find out why there are not enough of them, but our task is to equalize the balances in the program and in the warehouse, that is, write off two units of material.

We put 6 pieces in the “Actual Quantity” column. We will immediately have a deviation of -2 pieces.

You can record the “Goods Inventory” document and print it.

Document Write-off of goods

Now let's create a write-off document. Click on the button in the inventory “Create based on” and select “Write off goods”:

The “Write-off of goods” document window will open:

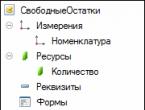

The program itself will determine that this is material (account 10.01) (according to the account in which it was stored) and will insert it into the tabular section. Click on the post button, then in 1C 8.3 we look at the postings for writing off the goods:

As you can see, we have written off two pieces of material to account 94.

The same could be done manually by creating the “Write-off of goods” document yourself and filling it out. It’s just more convenient through the “Inventory” document.

Based on materials from: programmist1s.ru

In any industrial construction or other organization where there is an item of material costs, the accountant is faced with the operation of writing off materials. In order to correctly prepare all documents and prevent violations when recording such business transactions, it is necessary to provide for a write-off method in the accounting policy. Accounting legislation allows accounting in 4 ways:

- At the cost of one unit;

- At average cost;

- LIFO method;

- FIFO method.

Tax accounting allows write-offs only using 2 of the listed methods, namely, the average cost or the FIFO method. In order to bring accounting and tax accounting as close as possible, it is recommended to use one of the methods, since recording deviations in accounting and tax accounting is a rather labor-intensive process.

Write-off of materials on demand-invoice

To write off materials in the 1C Enterprise program version 8.3, you must select the write-off method specified in the organization’s accounting policy. This can be done through the “Main” tab, subsection “Settings” - “Accounting Policy”.

This button opens the log of registered documents. To create a new accounting policy, you need to click the “Create” button to adjust an existing one by double-clicking on the desired item from the list.

In the document that opens, select the inventory tab and the write-off method from the list in accordance with local regulations.

The “Customer Materials” tab is filled in only when working with materials received from customers. The document is posted using the “Post and Close” button. Postings created by the document can be checked through the “Dt/Kt” button.

The “Print” button allows you to generate paper in 2 options:

- Free form of demand-invoice (without indicating price and value);

- Unified form M-11.

Important: to reflect the transfer of materials to production in some industries where material costs are written off in accordance with standards, one document of the requirement-invoice is not enough, for example, in construction it is necessary to draw up form M-29.

Disposal of materials with a long use cycle

For some material assets, such as inventory, household supplies, special clothing and special equipment, accounting legislation does not allow a one-time write-off, since their service life is equal to or exceeds 12 months. The release of such inventory items into production is documented in 1C with the document “Transfer of materials into operation,” which can be opened through the “Warehouse” tab, section “Workwear and equipment.”

The button opens a list of entered documents, where you can edit them or create a new one.

A new commissioning is completed using the “Create” button. When creating, be sure to specify the “Warehouse” parameter. The document has 3 bookmarks depending on the subaccount on which material assets are reflected:

- Workwear;

- Special equipment;

- Inventory and household supplies.

Positions are entered into the document using the “Add” button or the “Selection” button.

After adding an item to the document, the following parameters must be specified:

- Individual;

- Purpose of use;

- Accounting accounts.

Each of the parameters can be selected from the drop-down list. The purpose of use is filled out in accordance with the approved accounting policies of the organization. You can edit this parameter or create a new one. In this case, it is necessary to indicate:

- Nomenclature item for which the parameter is set;

- Name, code;

- Quantity according to the issuance rate;

- Payment method;

- Useful life;

- Method of reflecting expenses.

Repayment of the cost will occur depending on the chosen method:

- By calculating depreciation using the straight-line method;

- By one-time repayment at the time of commissioning;

- Proportional to the volume of products produced.

Indicating the method of recording expenses is necessary for correct reflection in the accounting accounts.

Important: if the parameter is not specified, some routine operations will not be performed automatically.

The document is posted after clicking the “Post” or “Post and Close” button. The document can be printed in 2 options:

- Unified uniform M-11;

- Issue record sheet according to the MB-7 form.

When posting a document, the cost of inventory items is repaid immediately and credited to production cost accounts, or repayment occurs in equal parts over the entire service life. To reflect the accrual of depreciation, it is necessary to create a document “Repayment of the cost of materials”. This operation is created automatically when closing the month, or it can be opened or created through the journal, which is located in the “Warehouse” section.

After a one-time repayment of the cost of materials, they are transferred to off-balance sheet accounts MTs01, MTs02, MTs03. In cases where material assets are returned by the individual to whom they were transferred, the return is documented in the document “Returns of materials from use.”

In case of complete depreciation of material assets, write-off from off-balance sheet accounts or from accounting accounts (if the material is not fully depreciated) is carried out using the document “Write-off of materials from use.”

This document allows you to print the unified MB-8 form.

Important: to correctly reflect the cost of written-off materials, it is necessary to carry out the routine operation “Adjustment of item cost”, which automatically edits the prices released for the production of inventory items, taking into account the specified parameters.