Withholding personal income tax. Forgot to withhold personal income tax: correcting the error We withheld personal income tax incorrectly, what to do

The employer calculates tax on all income of the taxpayer, the source of which is the employer, with the exception of income in respect of which the calculation and payment of tax are carried out by the employee independently (for example, a company employee sold his personal car - in this situation the organization will not be a tax agent. The employee has already You must calculate personal income tax yourself and submit a tax return). Grounds – clause 1 of Art. 210 Tax Code of the Russian Federation.

Tax amounts are calculated by tax agents on an accrual basis from the beginning of the tax period based on the results of each month in relation to all income for which a tax rate of 13% is applied, accrued to the taxpayer for a given period, with the offset of the amount withheld in previous months of the current tax period tax The tax is calculated taking into account tax deductions established by Chapter. 23 Tax Code of the Russian Federation. The tax period for calculating personal income tax is the calendar year. Basis – Art. 216 of the Tax Code of the Russian Federation.

Depending on the tax status of the employee and the type of his income, different types of rates are established:

– 9%;

– 13%;

– 15%;

– 30%;

– 35%. Basis – Art. 224 Tax Code of the Russian Federation.

The tax amount is calculated without taking into account the income received by the taxpayer from other tax agents and the tax amounts withheld by other tax agents. Tax agents are required to withhold the accrued tax amount directly from the taxpayer’s income upon actual payment.

Personal income tax is withheld from the employee by the employer (tax agent) upon actual payment of funds (wages) to the taxpayer. Moreover, the withheld tax amount cannot exceed 50% of the payment amount. Grounds – clause 4 of Art. 226 Tax Code of the Russian Federation.

If it is impossible to withhold from the taxpayer the calculated amount of tax, the tax agent is obliged, no later than one month (from the date of the end of the tax period in which the relevant circumstances arose), to inform the taxpayer and the tax authority at the place of his registration in writing about the impossibility of withholding the tax and the amount of tax.

When should personal income tax be transferred to the budget?

Tax agents are required to transfer the amounts of calculated and withheld tax no later than the day of actual receipt of cash from the bank for the payment of income, as well as the day of transfer of income from the accounts of tax agents in the bank to the accounts of the taxpayer or, on his behalf, to the accounts of third parties in banks.

In other cases, tax agents transfer the amounts of calculated and withheld tax no later than the day following the day the taxpayer actually receives income, for income paid in cash, as well as the day following the day of actual withholding of the calculated tax amount, for income received by the taxpayer in in kind or in the form of material benefits.

The total amount of tax calculated and withheld by the tax agent from the taxpayer, in respect of which it is recognized as a source of income, is paid at the place of registration of the tax agent with the tax authority.

How to pay personal income tax to a separate division?

Tax agents - Russian organizations with separate divisions are required to transfer calculated and withheld tax amounts, both at their location and at the location of each of their separate divisions.

The amount of tax payable to the budget at the location of the separate division is determined based on the amount of income subject to taxation accrued and paid to the employees of these separate divisions.

You cannot pay personal income tax at the expense of employers. When concluding contracts, employers do not have the right to assume obligations to bear the costs associated with paying personal income tax for an employee.

6 personal income tax deductions

To understand what the date of tax withholding in 6-NDFL is, you need to look at Article 226 (clause 4) of the Tax Code of the Russian Federation. There is a detailed description of this concept.According to the law, the date of personal income tax withholding is understood as the moment when the actual payment of income occurs. Accordingly, tax agents withhold the required amount of income tax from this amount.

The same article states: if the payer’s income is expressed in kind, that is, not in money, then personal income tax still has a monetary form. And they keep it at the expense of absolutely any income in monetary terms.

Salary

There is also an important nuance that tax agents must take into account. Many enterprises now have a common form of remuneration for employees, such as prepaid wages.

That is, it is divided into two parts:

1. advance;

2. the rest of the salary.

In this case, the date of withholding income in 6-NDFL is the time of final settlement with the employee. That is, the tax is collected not after the advance payment, but when the person receives the final payment for the last month.

Vacation pay

The same applies to a situation such as an employee’s vacation. Today, in every company, an employee, having written an application for vacation, has the right to expect to receive a certain amount just before the start of his vacation. These are so-called vacation pay, which are calculated from a person’s total income.

In fact, the employee receives the same advance payment, which will then reduce the basic salary for the period that includes this very vacation. And if there are vacation pay, the date of deduction in 6-NDFL is determined, as in the case of an advance: only after the employer has fully paid the employee for the past period. Namely, the last day of the corresponding month).

If you can't hold on

There are situations when an individual is not obliged to pay tax to the budget. For example, personal income tax cannot be withheld if a person has no real cash income. The result is a situation where tax has been assessed, but there is nothing to pay it from. Therefore, actual personal income tax is not withheld.

In this case, paragraph 5 of Art. 226 and paragraph 14 of Art. 226.1 of the Tax Code, as well as letter of the Federal Tax Service No. BS-4-11/12975. According to them, the amount of tax that was assessed but not withheld is still shown in form 6-NDFL. It is entered in line 080.

Personal income tax withholding date

The date of actual receipt of income is determined as:The day of payment of income, including its transfer to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties (when receiving income in cash);

day of transfer of income in kind (if income is received in kind);

the day of acquisition of goods (works, services), acquisition of securities (upon receipt of income in the form of material benefits);

day of offset of counterclaims of the same type;

the day the bad debt is written off from the organization’s balance sheet in accordance with the established procedure;

the last day of the month in which the advance report is approved after the employee returns from a business trip;

the last day of each month during the period for which borrowed (credit) funds were provided (if income arises in the form of material benefits from savings on interest when receiving borrowed (credit) funds).

When receiving income in the form of wages, the date of actual receipt by the taxpayer of such income is the last day of the month for which income was accrued for work duties performed in accordance with the employment agreement (contract). If the employment relationship is terminated before the end of the calendar month, the date of actual receipt by the taxpayer of income in the form of wages is considered to be the last day of work for which the income was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation).

Personal income tax withholding date

According to paragraph 4 of Art. 226 of the Tax Code of the Russian Federation, tax agents are required to withhold the accrued amount of tax directly from the taxpayer’s income upon their actual payment. It should be taken into account that, according to clause 6 of Art. 226 of the Tax Code of the Russian Federation in the new edition, in the general case, the transfer is made no later than the day following the day of payment of income to the taxpayer.

Only when paying a taxpayer income in the form of temporary disability benefits (including benefits for caring for a sick child) and in the form of vacation pay, tax agents are required to transfer the amounts of calculated and withheld tax no later than the last day of the month in which such payments were made.

Personal income tax withholding period

Deadlines for withholding and paying personal income tax in different cases:I. Type of income: wages.

The last day of the month for which the employee is paid. If an employee is fired before the end of the calendar month, the last working day for which the employee’s salary was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation).

The day the bank receives funds for wages or the day the funds are transferred to employee accounts (Clause 6 of Article 226 of the Tax Code of the Russian Federation).

II. Type of income: Income not related to wages (cash).

Day when personal income tax needs to be calculated:

1. The day of payment of money from the cash register.

2. The day the money is transferred to the employee’s bank account.

3. The day of transfer of money on behalf of the recipient of income to the accounts of third parties (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

Day when personal income tax must be transferred to the budget:

1. The day you receive money from the bank for wages.

2. The day the funds are transferred to the employee’s account.

3. The day of transfer of funds to the accounts of third parties (clause 6 of Article 226 of the Tax Code of the Russian Federation).

III. Type of income:

Income not related to wages (in kind).

Day when personal income tax needs to be calculated:

1. Day of transfer of inventory items.

2. The day of completion of work (services) in the interests of a person.

3. The day of payment per person for goods, works, services (subclause 2, clause 1, article 223 of the Tax Code of the Russian Federation).

Day when personal income tax must be transferred to the budget:

No later than the day following the day of actual tax withholding (clause 6 of Article 226 of the Tax Code of the Russian Federation).

IV. Type of income:

Income not related to wages (material benefit).

Day when personal income tax needs to be calculated:

1. The day of payment of interest on borrowed (credit) funds (subclause 3, clause 1, article 223 of the Tax Code of the Russian Federation).

2. Day of repayment of funds under the interest-free loan agreement.

Day when personal income tax must be transferred to the budget:

No later than the day following the day of actual tax withholding (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Withholding personal income tax from wages

Very often, individual entrepreneurs and LLCs with hired employees are interested in the question of how to withhold personal income tax from employees’ wages. In our material today we will look into this issue.We will also look at how to return over-withheld personal income tax.

Types of deductions from wages (or from other income) can be divided into the following groups:

1. Mandatory, which are carried out on the basis of the norms of the current legislation of the Russian Federation.

2. Deductions at the initiative of the employer (in accordance with labor legislation).

3. Deductions at the initiative of the employee (based on a corresponding statement written by him).

Based on the legislation of the Russian Federation, all deductions that are made from an individual’s salary belong to the first group of deductions and are mandatory.

Features of personal income tax deduction from wages

Withholding of personal income tax from wages is carried out on the basis of the tax base, tax deductions and tax rates. It should be noted that they are used to calculate income tax only for residents of the Russian Federation.

The tax rate, depending on individual income, can be:

For residents of the Russian Federation - 9%, 13% and 35%;

for non-residents of the Russian Federation - 30%.

In accordance with Article 217 of the Tax Code of the Russian Federation, some income is not taxed and is not taken into account when calculating personal income tax.

Tax deductions affect the calculation of personal income tax. Let's look at them in a little more detail. A tax deduction is the amount by which the tax base is reduced (before calculating the amount of tax payable).

The types of personal income tax deductions are as follows:

1. STANDARD DEDUCTIONS (ARE PROVIDED TO THE SUCH CATEGORIES OF CITIZENS):

Parents who are dependent on a student (who is under 24 years of age);

parents (adoptive parents, guardians) who have minor children.

2. SOCIAL DEDUCTIONS (ARE PROVIDED FOR THE SUCH PURPOSES):

For personal training or for teaching children;

for treatment;

for the purchase of medicines;

for pension provision.

3. PROPERTY DEDUCTIONS (ARE PROVIDED FOR THE SUCH PURPOSES):

Selling a car;

purchase (sale) of real estate (apartment, house, land).

The property deduction can only be used once.

Property deductions are discussed in detail in Article 218 of the Tax Code of the Russian Federation.

Procedure for withholding personal income tax from the minimum wage

If a citizen receives a minimum income that is no more than the established subsistence level, this does not exempt him from paying personal income tax, which will be calculated according to general rules.

An employee is entitled to only one standard tax deduction. The only benefit that can be summed up is the deduction for each child.

That is, when calculating personal income tax on an employee’s minimum salary, the tax will be withheld at the established rate of 13% or 30% minus the amount of the benefit.

The employer can withhold additional payments to the FSSP or alimony only after the personal income tax has been calculated.

The procedure for withholding personal income tax for a separate division of the organization

In accordance with paragraph 7 of Article 226 of the Tax Code of the Russian Federation, an organization that has separate divisions pays income tax for individuals at the location of each of them. The amount of personal income tax payable is determined on the basis of the amount of income of taxpayers that was received under civil contracts and employment contracts. Income tax is paid at the location of the separate division of the organization.

One important point should be paid attention to. Let's assume that an employee worked in several separate divisions of an LLC for a month. In such a situation, the withholding of personal income tax and payment of tax on the income of a given individual is made to the budgets at the location of each of the separate divisions of the organization. The time actually worked in each of the separate divisions of the organization is also taken into account.

What is not subject to personal income tax calculation?

We have already mentioned that among the income there are those that are not subject to income tax calculation, namely:

Social pensions;

social benefits;

maternity benefits;

scholarships;

alimony;

unemployment benefits;

compensation (daily expenses);

sick leave.

The full list is contained in Article 217 of the Tax Code of the Russian Federation.

Return of over-withheld personal income tax

In order to make a personal income tax refund, an individual must write a statement, which can be written in any form. The document must include the taxpayer's bank account details. It is to him that the excess withheld personal income tax will be returned.

Today, there are two options for returning excessively withheld personal income tax.

Option 1

After the expiration of the tax period, that is, at the end of the reporting year, when settlements related to the employee have already been completed, the individual entrepreneur does not have the right to refund the excess withheld income tax. In this case, the taxpayer can independently contact the tax service to receive the funds due to him.

Tax officials themselves will recalculate personal income tax if the employee provides them with the following list of documents:

Statement;

declaration;

documents confirming the applicant's right to return.

The money will go to the bank account specified in the employee’s application.

Option 2

When personal income tax payments for an employee have not yet been completed, an individual entrepreneur can independently pay the individual.

The procedure in this situation is as follows:

1. Check the employee’s statement.

2. Recalculate income tax.

3. Prepare an accounting statement.

4. Notify the employee about the overpayment of personal income tax.

5. At the request of the employee, return the funds to him.

6. Make changes to the tax card (it indicates accruals, transfers and withholdings of income tax).

The individual entrepreneur is obliged to notify the employee of the fact of excessive tax withholding and inform him of the amount within 10 days from the moment this fact is discovered.

Terms for returning excessively withheld personal income tax

An individual entrepreneur makes a refund of income tax from funds that must be transferred to the budget both for a specific taxpayer and from the income of his other employees.

Refunds of over-withheld personal income tax must be made within three months from the date of receipt of an application for a refund from an individual. If the individual entrepreneur does not pay the employee the amount on time, the entrepreneur is obliged to pay interest to the employee.

It may happen that an individual entrepreneur does not have the opportunity to refund income tax to an employee due to the fact that the individual entrepreneur’s accounts are frozen. In such a situation, the employee needs to contact the tax office, which will refund the personal income tax to the individual at its own expense.

Withholding personal income tax upon dismissal

Employers usually pay wages either on the 5th or 10th of the month. Personal income tax upon dismissal, according to the norms of the Tax Code of the Russian Federation, should be sent to the budget either on the day the funds are issued or on the next day, depending on how the salary is paid. For example, if a company transfers money to plastic cards or withdraws cash from a bank to issue salaries, then personal income tax must be paid on the same day. And if you use cash proceeds, then personal income tax should be transferred no later than the next day. But this procedure for paying wages and paying taxes on them is not applied in the final settlement with the employee. After all, the day of dismissal and the day of payment do not necessarily coincide. Let's say the May salary is issued on June 10, the employee quits on May 24 - when should all the calculations be made in this case? In such cases, consultation with specialists helps; we’ll figure out what the Ministry of Finance has to say.Explanations from the Ministry of Finance about funds paid upon dismissal

The employer must pay the employee who wrote the resignation in full on the last working day - pay for all days of work last. months, bonuses, debt, other amounts - all this should be included in the final figure.

This procedure is provided for in Article 140 of the Labor Code of the Russian Federation and must be absolutely observed. After all, if the salary, incl. Payments upon dismissal are delayed, then serious (up to criminal) liability may occur.

If on the day of dismissal the employee does not come for the work book and paycheck, then he will have to postpone the payment of the last salary, but the final payment will be made immediately after the fired person comes to work to pick him up.

Note that the accountant can postpone the last payment of wages to the next day after attendance - this is applicable when an employee, for example, gets sick, and it will be necessary to recalculate the total payment amounts taking into account sick leave, and this takes time.

Most often, the employee receives his final pay on the day of dismissal. But, if he does not come for it on time, he will receive it at least the next day after he comes to pick up his work book.

Now in more detail - within what period is personal income tax paid upon dismissal?

The Russian Ministry of Finance explains the situation as follows: according to the general rule, the date of receipt of income in the form of wages is the last day of the month in which such income was accrued. But if an employee quits earlier, then this date is the last day of work.

According to clause 6 of Article 226 of the Tax Code of the Russian Federation, the employer must transfer personal income tax no earlier than the day on which the employee receives income, or the next day if the money was issued from cash proceeds.

The Financial Department explains that the same deadlines should be followed when the last salary is paid. For example, if a salary is transferred to a card, personal income tax must be paid on the settlement amounts on the same day on which the money is transferred to the employee’s card. And if from the cash register - at least the next day.

The Ministry of Finance also reminds that the specified personal income tax payment deadlines apply to all payments to the employee. Those. We are talking about the salary in the last month, and about benefits, and about compensation for (if it was not used) vacation.

Withholding personal income tax posting

The calculation and withholding of personal income tax is accompanied by the implementation of the corresponding entries in accounting. The article provides a table with entries for calculating tax payable, as well as examples of calculating personal income tax on dividends, interest on a loan and employee wages. After considering this topic, we will deal with personal income tax reporting.Postings for personal income tax

To account for personal income tax, account 68 “Calculations for taxes and fees” is used, on which the “NDFL” subaccount is opened. When calculating personal income tax for payment to the budget, it is reflected on the credit account. 68 in correspondence with the income accounts of an individual. Tax payment is reflected in the debit of account 68.

Postings for withholding and paying personal income tax:

|

Debit |

Credit |

Operation name |

|

Personal income tax is withheld from dividends of founders and shareholders. |

||

|

Personal income tax is withheld from employee wages. |

||

|

Tax payable on financial assistance to employees. |

||

|

Tax payable on civil income. |

||

|

Tax is withheld from income in the form of interest payable from a short-term loan or a loan from an individual. |

||

|

Tax is withheld from income in the form of interest payable from a long-term loan or loan from an individual. |

||

|

The total personal income tax payable is transferred to the budget |

Example of personal income tax calculation on dividends:

Ivanov I.A., who is the founder, received dividends in the amount of 50,000 rubles. How is personal income tax calculated on Ivanov’s dividends in this example, and what transactions are made?

Postings for withholding personal income tax from dividends:

An example of calculating personal income tax on interest received on a loan:

The company received a short-term loan from Ivanov I.A. in the amount of 200,000 rubles. Interest on the loan amounted to 10,000 rubles. Let's calculate the personal income tax in this example and make the necessary entries.

A personal income tax rate of 13% is applied to income in the form of interest from a short-term loan.

Personal income tax = 10,000 * 13 / 100 = 1,300 rubles.

Postings for withholding personal income tax on loan interest:

|

Sum |

Debit |

Credit |

Operation name |

|

Received a short-term loan from Ivanov |

|||

|

Interest accrued for using the loan |

|||

|

Personal income tax accrued on interest |

|||

|

Borrowed funds were returned including interest |

|||

|

Tax payable is transferred to the budget |

An example of calculating personal income tax from wages:

Ivanov received a salary including a bonus of 30,000 rubles. Ivanov has the right to a deduction of 500 rubles, and he also has one child.

Let's calculate the personal income tax on this salary and make the necessary entries to withhold it:

Salary minus deductions is subject to a tax rate of 13%.

Personal income tax = (30,000 - 500 - 1400) * 13 / 100 = 3653 rubles.

Ivanov will receive a salary in his hands = 30,000 - 3653 = 26,347 rubles.

Postings for calculating personal income tax from salary:

You can also see an example of calculating personal income tax from wages in the article “Example of payroll.”

The posting of personal income tax withholding from wages is made on the last day of the month for which wages are accrued.

Personal income tax on other income is calculated on the day the employee receives this income.

This concludes our discussion of personal income tax. We have dealt with the concept of personal income tax, the features of calculation, the tax base and tax rates, you can also look at the personal income tax reporting and download the 2-personal income tax form and the register of information on the income of individuals. Next, let's get acquainted with another tax - income tax.

Withholding personal income tax from vacation pay

Tax payments on vacation pay are made as usual.Only amendments were introduced regarding the timing of accrual and transfer of personal income tax to the treasury, in particular:

Previously, tax was withheld from vacation payments on the day the funds were actually transferred to the employee (in cash or to a bank account);

- now the employer has the right to calculate and submit income tax to the Federal Tax Service until the end of the month in which payments were made to the employee for vacation.

The new requirements are more convenient for tax agents, since now they will not have to pay vacation pay to employees on the same day, take payments into account in accounting and tax documents, or transfer personal income tax to the treasury.

When answering the question of how to pay personal income tax on vacation pay, you should first of all calculate the amount of tax.

Despite new legislative requirements that allow tax to be calculated and transferred to the budget before the last date of the month, experienced accountants advise immediately determining income tax in the process of calculating vacation pay.

In general, the calculation procedure is as follows:

The total value of vacation pay is reduced by the amount of social, property, standard, professional, investment tax deductions due to the employee (Articles 218, 219, 219.1, 220, 221 of the Tax Code of the Russian Federation).

- Contributions for pension, social, and medical insurance are calculated on the total amount of vacation pay (Article 7 of Federal Law-212).

- In the same way, deductions for insurance against occupational diseases and accidents are calculated and deducted from the tax base (Article 20.1 of Federal Law No. 125).

- Personal income tax is charged on the remaining amount at a rate of 13%.

It is important to remember that if the employee does not use the next vacation in full immediately, but in the form of several stages during the year, then personal income tax is accrued only on the amount of vacation pay actually paid.

In addition, many accountants ask the question whether deductions established by tax law are deducted from the tax base when collecting income tax on vacation pay.

As defined above, deductions are taken into account in the usual manner, that is, they reduce the size of the tax base.

Withholding of alimony personal income tax

Collection of alimony is made after deduction of personal income tax from wages and other income (clause 4 of the List, clause 1 of Article 99 of Law No. 229-FZ).If the employer provides the employee with a property deduction, that is, pays him wages without withholding personal income tax, then alimony must be calculated from the entire amount of the employee’s wages (income). (Letter of Rostrud of the Russian Federation No. 2261-6-1).

If an employee applies to the tax authorities for a property deduction (to do this, he submits a declaration based on the results of the year 3-NDFL), the tax authorities check this declaration, provide a property deduction and return the excessively withheld personal income tax amounts to the employee’s current account.

It turns out that during the year personal income tax is withheld, income is reduced by the amount of personal income tax and alimony is withheld after personal income tax is withheld. The alimony payer must pay alimony from the amounts returned by the tax authorities independently. There are no controls for this yet.

The law establishes restrictions on the withholding of alimony. When executing a writ of execution (several writs of execution), no more than 50% of wages and other income may be withheld from a debtor-citizen (Clause 2 of Article 99 of Law No. 229-FZ).

When we talk about writs of execution, we do not always mean payment of alimony. Executive documents may also relate to other situations. If an employee pays alimony under several writs of execution or court orders, the amount of withholding should not exceed 70%.

If the employee’s income is not enough, then the following requirements are satisfied first:

About payment of alimony;

with compensation for harm caused to health;

with compensation for damage to persons who suffered damage as a result of the death of the breadwinner (subparagraph 1, paragraph 1, article 111 of Law No. 229-FZ).

Example. The employee's salary for July is 30,000 rubles.

Personal income tax is withheld at a rate of 13%. The employee is provided with a standard deduction for two children in the amount of 2,800 rubles.

The accounting department received two writs of execution for the employee:

To pay child support for two minor children in the amount of 1/3 of earnings;

- compensation for material damage due to an accident in the amount of 10,000 rubles.

The personal income tax amount is 3,536 rubles ((30,000 - 2,800)*13%).

The amount of wages minus personal income tax is 26,464 rubles. (30,000 - 3,536).

First of all, alimony for a minor child is withheld (up to 70% of the salary) in the amount of 8,821.33 rubles (26,282 * 1/3).

Secondly, compensation for moral damage, provided that the total amount of deductions (including alimony) does not exceed 50% of earnings.

The maximum amount of deductions from an employee’s salary (50%) is 13,232 rubles. (RUB 26,464*50%). Consequently, the amount of deduction for compensation for material damage due to an accident will be 4,410.67 (13,232 rubles - 8,821.33 rubles). The debt for compensation for material damage, which will need to be collected from the employee next month, will be 5,589.33 rubles (10,000 rubles - 4,410.67 rubles).

Withholding personal income tax from advance payment

The law obliges the contribution to be made to the accounts of the tax inspectorate on the same day when the payment of remuneration for labor is made. But there are other rules that accountants need to consider when it comes to issuing advances.What is the right thing to do in this case so that there are no troubles in relations with tax inspectors?

Accountants can glean the necessary information from the following regulatory documents relating to this issue:

Article 136 of the Labor Code of the Russian Federation;

letter of the Ministry of Finance of Russia No. 03-04-06/13294;

Articles 123 and 223 of the Tax Code of the Russian Federation.

If the personal income tax is not paid on time, the company may be punished with penalties.

This is stipulated in Art. 123 of the Tax Code of the Russian Federation, and the amount sometimes reaches 20% of the amount of the obligation. Therefore, many accountants, fearing a fine, are concerned about when it is necessary to make these deductions when paying an advance in 2016 - at the time of preliminary payment of part of the salary or when they fully pay workers for their work at the end of the month.

From the text of Art. 223 of the Tax Code of the Russian Federation it follows that the date of payment of wages should be recognized as the final day in the month for which the worker was paid a salary or the last calendar date of the performance of the job duties of the resigning employee.

According to the rules of current legislation, personal income tax must be paid together with wages.

As for the advance, the rationale is somewhat different: this is a part of the income that is previously given to the employee in the middle of the month, but subsequently it is subject to deduction from the amount of remuneration after the end of the reporting period.

However, as with all rules, there is one exception in relation to companies that have internal documents stating that salaries must be paid to the staff once every 2 weeks.

In such organizations, the withholding and payment of personal income tax occurs simultaneously with each payment of earnings to the working staff.

Thus, they make payments to the budget twice in 30 days.

Personal income tax on salary advance

Is it necessary to pay tax on advance payments to workers? This question interests many enterprises, because... The tax withholding system is constantly being adjusted.

Let's look at what current legislation offers to companies in this matter.

However, there is also no need to pay personal income tax on the advance payment to the tax office.

Let's list the main “fresh” standards:

The new rules now stipulate that the employer must send the income tax no later than the date following the day of full payment of wages for the month worked. But if the date coincides with a holiday or weekend, then the period is extended until the first working day following them.

Contributions withheld from vacation and sick leave must now be sent to the budget no later than the day ending the working month in which they were paid. However, if the payment was made in kind for work activity, then the income tax must be sent the very next day and no later.

There are also some innovations regarding the time for submitting reports that cannot be ignored.

Impossibility of withholding personal income tax

According to tax legislation, personal income tax agents are Russian organizations, individual entrepreneurs, notaries engaged in private practice, lawyers who have established law offices, as well as separate divisions of foreign organizations in the Russian Federation from which or as a result of relations with which the taxpayer received income.One of the duties of tax agents provided for in paragraph 5 of Art. 226 of the Tax Code of the Russian Federation is a written message to the taxpayer and the tax authority about the impossibility of withholding tax. As noted in Letter No. SA-4-7/16692 of the Federal Tax Service of the Russian Federation, the impossibility of withholding tax arises, for example, in the case of payment of income in kind or the occurrence of income in the form of material benefits.

This obligation should not be confused with the obligation provided for in paragraph 2 of Art. 230 of the Tax Code of the Russian Federation, namely with the obligation to submit to the tax authority at the place of registration information about the income of individuals for the expired tax period and the amounts of taxes accrued, withheld and transferred to the budget system of the Russian Federation for this tax period.

A notification about the impossibility of withholding tax is submitted no later than one month from the end of the tax period, that is, in relation to income. However, it falls on a day off - Saturday, therefore, in accordance with paragraph 7 of Art. 6.1 of the Tax Code of the Russian Federation, the expiration date is considered to be the next working day following it.

Information in accordance with paragraph 2 of Art. 230 of the Tax Code of the Russian Federation are submitted no later than April 1 of the year following the expired tax period.

Form for reporting the impossibility of withholding personal income tax

In paragraph 5 of Art. 226 of the Tax Code of the Russian Federation states that the form of notification of the impossibility of withholding personal income tax and the amount of tax and the procedure for submitting it to the tax authority are approved by the federal executive body authorized for control and supervision in the field of taxes and fees. Clause 2 of the Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/611@ establishes that the message about the impossibility of withholding tax and the amount of tax in accordance with clause 5 of Art. 226 of the Tax Code of the Russian Federation is submitted in the form approved by clause 1 of this order, that is, in the same form in which information is submitted in accordance with clause 2 of Art. 230 of the Tax Code of the Russian Federation (form 2-NDFL).

Fill out a message about the impossibility of withholding personal income tax

The procedure for filling out 2-NDFL certificates submitted in accordance with clause 5 of Art. 226 and paragraph 2 of Art. 230 of the Tax Code of the Russian Federation, varies. Here are the features you should know when filling out the 2-NDFL certificate in accordance with clause 5 of Art. 226 Tax Code of the Russian Federation.

Example:

For the period from January to May, Vostok LLC paid its employee a salary in the amount of 75,000 rubles, from the indicated income it was calculated, withheld and transferred to the personal income tax budget in the amount of 9,750 rubles. In June, the employee received income in kind in the amount of 5,000 rubles. The organization calculated personal income tax on this income in the amount of 650 rubles, but did not withhold it. No deductions were provided to the employee. The employee had no other income.

What personal income tax reporting must an organization submit to the tax authority?

In this case, the organization must generate two 2-NDFL certificates for this employee: with attribute “1” and attribute “2”.

When filling out a certificate with sign “2” in section. 3 indicates the amount of income equal to 5,000 rubles, and in clause 5.3 of section. 5 of the certificate, the calculated amount of tax is entered - 650 rubles, in clause 5.7 of section. 5 reflects the amount of tax not withheld by the tax agent - 650 rubles.

When filling out a certificate with attribute “1” in section. 3 indicates the amount of income - 80,000 rubles, in paragraph 5.3 - 5.5 section. 5 of the certificate indicates the calculated amount of tax - 10,400 rubles, the withheld and transferred amount of tax - 9,750 rubles, and in clause 5.7 of section. 5, the amount of tax not withheld by the tax agent is entered, equal to 650 rubles.

Examples of filling out certificates are given on pages 37 – 38.

Message about the impossibility of withholding personal income tax and the accrual of penalties

Letter No. BS-4-11/20951 of the Federal Tax Service of the Russian Federation discusses the issue of financial consequences for the tax agent in the form of accrual of penalties if a message about the impossibility of withholding personal income tax is not submitted.

Thus, specialists of the main tax department indicated that if the tax agent, in the prescribed manner and within the prescribed time frame, informed the taxpayer and the tax authority at the place of his registration in writing about the impossibility of withholding personal income tax in relation to a specific person and the amount of tax, then no penalties are charged to the tax agent.

If the tax agent has not lost the ability to withhold personal income tax from the employee’s income, and also has not notified the taxpayer and the tax authority at his place of registration in writing about the impossibility of withholding personal income tax and the amount of tax, penalties may be charged to the tax agent in accordance with Art. 75 of the Tax Code of the Russian Federation in the prescribed manner on the date of the decision based on the results of the on-site tax audit, and the taxpayer must be sent a request to pay the tax in accordance with clause 2 of Art. 70 Tax Code of the Russian Federation.

A similar position is presented in a later clarification of the department - in Letter No. SA-4-7/16692.

Also in Letter No. SA-4-7/16692, the tax authorities noted that after the end of the tax period in which the tax agent pays income to an individual, and a written message from the tax agent to the taxpayer and the tax authority at the place of registration about the impossibility of withholding personal income tax, the obligation to pay tax is assigned to an individual, and the tax agent’s obligation to withhold the corresponding amounts of tax is terminated. After notification from the tax agent, the tax must be paid by the taxpayer himself when submitting a personal income tax return to the tax authority at his place of registration.

Responsibility for failure to submit a message about the impossibility of withholding personal income tax

Failure to provide information in Form 2-NDFL (regardless of the basis for sending it) is qualified as failure to provide the tax authority with information necessary for tax control, and in accordance with clause 1 of Art. 126 of the Tax Code of the Russian Federation is punishable by a fine of 200 rubles. for each document not submitted.

A more interesting issue in this case is liability for failure to provide information with sign “1” in the event that this information has already been submitted with sign “2” and there is no other information about the income of an individual. Taking into account the procedure for filling out the 2-NDFL certificate, in this case the data indicated in the certificates duplicate each other.

For a clearer understanding of the problem, we present the situation discussed in the Letter of the Federal Tax Service for Moscow No. 20-15/021334. An organization that is a tax agent for personal income tax and does not have the ability to withhold personal income tax from payments in favor of taxpayers, asked the question: is it necessary to submit 2-NDFL certificates with the “1” attribute if the organization has already submitted 2-certificates to the tax authority for these individuals? Personal income tax with sign “2” and there will be no new information in the certificates?

The capital's tax authorities responded: submitting a certificate with sign "2" does not relieve the tax agent from the obligation to submit a certificate with sign "1".

It should be noted that tax authorities and financiers are adamant on this issue. Thus, the Ministry of Finance in Letter dated December 29, 2011 No. 03 04 06/6-363 indicated that the duties of a tax agent under Art. 230 of the Tax Code of the Russian Federation are assigned to the organization regardless of the responsibilities established by Art. 226 Tax Code of the Russian Federation.

Thus, the organization’s fulfillment of the obligation to report the impossibility of withholding tax and the amount of tax in accordance with clause 5 of Art. 226 of the Tax Code of the Russian Federation does not relieve an organization from the obligation to provide information on the income of individuals of the expired tax period and the amounts of taxes accrued, withheld and transferred to the budget system of the Russian Federation in accordance with clause 2 of Art. 230 of the Tax Code of the Russian Federation, including if the organization does not pay the taxpayer other income subject to personal income tax.

Tax officials also adhere to this opinion in court. Thus, in response to statements from tax agents, tax officials give the following arguments:

The norms of the Tax Code of the Russian Federation do not provide for the exemption of a tax agent from the obligation to provide information on the income of an individual in accordance with clause 2 of Art. 230 of the Tax Code of the Russian Federation in the presence of a message sent on the basis of clause 5 of Art. 226 of the Tax Code of the Russian Federation, since these norms presuppose two different grounds for control exercised by the tax authority (FAS Resolution UO No. F09-5625/14);

tax agent, submitting in accordance with paragraph 5 of Art. 226 of the Tax Code of the Russian Federation information about the impossibility of withholding tax amounts, did not fulfill the provisions provided for in paragraph 2 of Art. 230 of the Tax Code of the Russian Federation is the obligation to submit to the tax authority information about the income of the same individuals and the amounts of accrued, withheld and transferred taxes on this income (certificate 2-NDFL with sign “1”), in connection with which the inspectorate was not able to carry out measures tax control in the absence of complete information on the amounts of income received by individuals in the corresponding tax period (Resolution of the Federal Antimonopoly Service UO No. F09-2820/14 (hereinafter referred to as Resolution No. F09-2820/14));

the deadlines for submitting 2-NDFL certificates with features “1” and “2” differ (Resolution No. F09-2820/14);

the duties of the tax agent to submit these certificates are enshrined in various norms of the Tax Code of the Russian Federation (Resolution No. F09-2820/14);

Current legislation does not provide for the exemption of a tax agent from the obligation to provide information on the income of an individual in accordance with paragraph 2 of Art. 230 of the Tax Code of the Russian Federation in the presence of a message sent on the basis of clause 5 of Art. 226 of the Tax Code of the Russian Federation (Resolution No. F09-2820/14);

elements of the offense provided for in paragraph 1 of Art. 126 of the Tax Code of the Russian Federation, is formal (Resolution No. F09-2820/14).

What do the judges say? How do they motivate their decisions? The good news for tax agents is that there is positive arbitration practice on this issue. At the same time, the judges indicate that the tax agent, having submitted to the inspectorate a 2-NDFL certificate with attribute “2”, which also contained all the necessary information to be indicated in the 2-NDFL certificate with attribute “1”, fulfilled the duties regulated by paragraph 5 of Art. . 226 ip. 2 tbsp. 230 of the Tax Code of the Russian Federation, in connection with which they satisfy the requirements of tax agents and recognize the decisions of the inspectorate as invalid. The arbitrators came to such conclusions in the decisions of FAS VSO No. A19-16467/2012, FAS UO No. F09-5625/14, No. F09-2820/14, No. F09-9209/13. In addition, the judges note that this interpretation of the provisions of paragraph 5 of Art. 226, paragraph 2 of Art. 230, art. 126 of the Tax Code of the Russian Federation is also consistent with the requirements of paragraph 7 of Art. 3 of the Tax Code of the Russian Federation, according to which all irremovable doubts, contradictions and ambiguities in acts of legislation on taxes and fees are interpreted in favor of the taxpayer (payer of fees).

If in relation to any income paid to an individual, the employer does not have the opportunity to withhold personal income tax, he, acting as a tax agent, is obliged to report this fact to the tax office. The message is drawn up in the form of a certificate in form 2-NDFL and submitted to the tax office. Ignoring this obligation, enshrined in clause 5 of Art. 226 of the Tax Code of the Russian Federation, entails various sanctions for the tax agent: starting with the accrual of penalties and ending with the accrual of a fine in accordance with paragraph 1 of Art. 126 of the Tax Code of the Russian Federation. According to the Ministry of Finance and the Federal Tax Service, the fulfillment of this obligation does not relieve the obligation to provide information in relation to the same individuals in accordance with paragraph 2 of Art. 230 of the Tax Code of the Russian Federation, even if the individual has no other income. However, the judges have a different opinion on this issue.

It happens that, by mistake of an accountant, personal income tax was not withheld from the employee and was not transferred to the budget. What to do in such cases and how to competently correct the error that has arisen with minimal risks?Payments are made during the tax period

Let's consider two options with clear examples: when payments are made to an employee in cash during the entire tax period (that is, a year) and when such payments are not expected.

Example No. 1.

In June 2017, employee Potapenko G.N. was accrued and paid vacation pay for 2 weeks of vacation in the total amount of RUB 28,673.00. Potapenko G.N. is a resident of the Russian Federation. Of the accrued vacation pay, 1,600.00 rubles were withheld and transferred to the personal income tax budget. Employees are not provided with personal income tax deductions.

However, the accountant made a tax mistake, since the amount of personal income tax to be withheld should be equal to RUB 3,727.00. (RUB 28,673.00 × 13%=RUB 3,727.00). That is, the tax on vacation pay was not withheld in full. A shortcoming in the calculation was discovered by the accountant on December 1, 2017. Potapenko G.N. continues to work and receives income in cash to the present day.

In the situation considered, the organization, as a tax agent, is recommended to recalculate the amount of personal income tax for the employee for the period from June 2017 to December 2017 inclusive and withhold until the end of the tax period (that is, until the end of 2017) from the employee’s cash income the missing amount of personal income tax 2127.00 rub. (for example, from wages, bonuses, sick leave, etc.) and transfer it to the budget. But at the same time, it is important to remember that the total amount of personal income tax withheld should not exceed 50% of the income paid in cash to the employee (clause 4 of Article 226 of the Tax Code of the Russian Federation).

Note: Additional tax can be withheld from an employee’s taxable income in cash only within the current tax period. In 2018, deductions can no longer be made. This is evidenced by the Letter of the Federal Tax Service of the Russian Federation dated October 26, 2016 No. BS-4-11/20405@. That is, in the example described above, the accountant has the opportunity to withhold the missing personal income tax in the amount of RUB 2,172.00. from the income of Potapenko G.N. for December 2017

But if an error in incorrect tax calculation had been found, say, in February 2018, then, accordingly, it would no longer be possible for the employer to withhold personal income tax. And in such a case, as a result of unlawful failure to withhold personal income tax based on the results of the expired tax period, sanctions from the Federal Tax Service in the form of a fine cannot be avoided by the employer. And the obligation to pay the unwithheld amount of personal income tax is transferred directly to the individual. In turn, the organization, as a tax agent, is required to submit to the Federal Tax Service a certificate 2-NDFL with attribute “2” for this employee - it will reflect information about unwithheld amounts of tax on the income of an individual for the tax period.

As for the collection of penalties for untimely withholding, there are two opinions - the Supreme Arbitration Court of the Russian Federation and the Federal Tax Service of the Russian Federation. Thus, the Supreme Arbitration Court of the Russian Federation, in its Resolution No. 57 of July 30, 2013, explains that penalties may be collected from a tax agent who did not withhold tax. However, the Federal Tax Service of the Russian Federation, in its letter No. ED-4-2/13600 dated August 4, 2015, states the following: due to the fact that transfer of personal income tax at the expense of a tax agent is not allowed, there are no grounds for collecting unwithheld tax from the tax agent , which means there are no grounds for collecting penalties, that is if personal income tax was not withheld by the employer, therefore, there should be no penalties.

But since the opinions of YOU and the Federal Tax Service differ, and besides, if the failure to withhold personal income tax is not justified, then the collection of penalties by the tax authority from the employer in the event of untimely withholding of tax (as described in example 1) may still be acceptable.

Let us remind you that the penalty is calculated based on 1/300 of the current refinancing rate, the amount of tax debt and the number of days overdue for payment.

If the tax inspectorate demands payment of penalties and fines, then they will definitely need to be repaid, otherwise you can expect the organization’s current account to be blocked.

No more payments expected

You need to act differently if during the remaining tax period the payment of income to the employee in cash was no longer made.

Example 2.

On November 15, 2017, employee I. D. Romanova was paid upon dismissal (wages for days worked amounted to RUB 20,500.00 and vacation compensation amounted to RUB 12,650.00). The accountant calculated the amount of personal income tax to be withheld and transferred to the budget in the total amount of 2665.00 rubles. The amount paid to the employee was RUB 30,485.00.

The accountant made a mistake - the amount of personal income tax was withheld only from the salary of I.D. Romanova, and personal income tax was not withheld from the amount of compensation for vacations not taken and was not transferred to the budget.

Unwithheld personal income tax amounted to RUB 1,645.00. Due to the fact that the employee quit and, accordingly, no more income will be paid to him, it is not possible for the employer to withhold the missing amount of tax from the employee during the tax period. In this situation, the employer must provide the tax authority with a notification about the impossibility of withholding tax from an individual and the amount of tax. This information is provided by the tax agent in the form of 2-NDFL certificates with attribute “2” for each individual for whom tax was not withheld.

In the considered example 2, a 2-NDFL certificate for employee I.D. Romanova must be submitted by the organization no later than March 1, 2018. After which the tax authority will send a notification to the individual I.D. Romanova. that she must independently pay the amount of personal income tax to the budget. In turn, the tax agent at the end of 2017 will also need to provide, in the general manner, 2-NDFL certificates for all individuals (employees) with attribute “1” and a 6-NDFL declaration for the 12 months of 2017 by April 2, 2018 However, it cannot be said that the tax inspectorate will not collect penalties and fines from the employer as a result of failure to withhold personal income tax amounts; this risk remains in such cases.

Personal income tax agent vacation pay

I The procedure for filling out the form of information on the income of an individual “Certificate of income of an individual” (Form 2-NDFL), approved by Order of the Federal Tax Service of Russia dated October 30, 2015 N ММВ-7-11/, a certificate of income of an individual to whom a tax agent was issued recalculation of personal income tax for previous tax periods in connection with the clarification of its tax obligations is issued in the form of a corrective certificate. If updated information is submitted to the tax authority, only the information that has been corrected is submitted. The updated information is presented in the form that was in effect in the tax period for which the corresponding changes are made (clause 5 of Section I of the Procedure for submitting to the tax authorities information on the income of individuals and messages about the impossibility of withholding tax and the amount of tax on personal income, approved by the Order of the Federal Tax Service Russia dated September 16, 2011 N ММВ-7-3/).

Personal income tax: we return, withhold, transfer

Additional entries in the personal income tax registers Since 2011, tax agents are required to keep records of the income of individuals, calculated and withheld tax in the new tax accounting register. Moreover, its form must be developed by the tax agent independently.

The list of information that must be reflected in the tax registers for personal income tax is given in paragraph 1 of Article 230 of the Tax Code. In No. 1 of the magazine “Salary” for this year, a sample tax register for personal income tax accounting was published - a tax card.

Attention

In No. 2 the procedure for filling it out is given. This tax register will show corrections regarding errors made in the calculation of personal income tax in 2011. After corrective operations have been carried out, they must be reflected in the personal income tax register.

Important

The transfer of arrears was made during the tax period. Indicators are indicated in the columns of the months in which the operations were carried out.

Personal income tax was not withheld: what should an accountant do?

Section 3 reflects all income received by an employee of the organization for the past tax period, taking into account the detected error, and section 4 - all standard, social and property deductions that the employer was obliged to provide to the employee. Section 5 calculates the total amount of income (line 5.1), the tax base (line 5.2) and the amount of calculated tax (line 5.3) based on the results of the past tax period.

In the updated certificate in Form No. 2-NDFL, these indicators are reflected taking into account the identified error. On line 5.4 “Amount of tax withheld,” you must indicate the amount of personal income tax that was reflected in the initial certificate.

The difference between lines 5.4 and 5.3 in case of detection of arrears is also entered in line 5.7 “Amount of tax not withheld by the tax agent.”

If personal income tax was not withheld from an individual’s income

The list and sequence of actions taken to correct an error that led to an underpayment of personal income tax to the budget depends on whether it is possible for a given tax agent to withhold an additional amount of tax or whether he does not have such an opportunity. Withholding personal income tax: opportunities for a tax agent The ability of a tax agent to withhold the personal income tax rate from an individual’s income is determined by several conditions.

Firstly, there is a contractual relationship between the taxpayer and the tax agent that involves the payment of income. That is, the employee is not fired, but continues to work and receive a salary, the contractor under a civil contract performs the agreed amount of work for a fee, etc.

d. Secondly, the agreement provides for the tax agent to pay income to the taxpayer in cash, that is, remuneration is provided not only in kind.

Personal income tax is not withheld. how to fix the error

Send them, along with a certificate in form 2-NDFL, another letter about the circumstances of the error, its reasons and, most importantly, what the taxpayer himself needs to do. From the editor. The tax agent is not obliged to send an explanatory letter to the taxpayer along with the certificate in Form 2-NDFL.

But just in case, we still provide a sample of it. Sample letter to a taxpayer Entries in personal income tax tax accounting registers In the personal income tax accounting register, the tax agent shows entries only for tax accrual, since he does not have the opportunity to withhold and transfer personal income tax. The amount of personal income tax calculated as a result of the recalculation is indicated in the column of the month when the income was accrued, from which the tax was not withheld in full (an error was made).

For example, the tax was not fully withheld in May 2010. Additional accrual is shown in the “May” column of Form 1-NDFL for 2010.

If it is impossible to withhold personal income tax due to the dismissal of an employee, the organization should inform the individual taxpayer and the tax authority in writing about the amount of unwithheld tax by sending him a certificate (certificates) of income in Form 2-NDFL. Justification: Based on clause 3 of Art. 24 of the Tax Code of the Russian Federation, tax agents are obliged, in particular: to correctly and timely calculate, withhold from funds paid to taxpayers, and transfer taxes to the budget system of the Russian Federation to the appropriate accounts of the Federal Treasury; submit to the tax authority at the place of your registration the documents necessary to monitor the correctness of calculation, withholding and transfer of taxes.

According to paragraph 3 of Art. 210 of the Tax Code of the Russian Federation for income in respect of which the tax rate established by clause 1 of Art.

Personal income tax for last year was not withheld by mistake, what should I do?

Let us consider the contents of the accounting certificate in this case. This document should:

- describe the essence of the error, the date when it was made, and its reason;

- give the correct version of personal income tax calculation and record the date of recalculation;

- indicate the amount of personal income tax that needs to be additionally calculated;

- indicate from what income of the taxpayer and when the additional accrued amount of personal income tax will be withheld;

- provide a calculation of the amount of penalties for late transfer of taxes to the budget;

- set the date for transferring arrears and penalties for personal income tax to the budget;

- propose adjusting entries for tax and accounting registers.

Let's look at the preparation of an accounting certificate using an example. Example 1 During the intersettlement period on January 18, 2011, sales manager of Pyramid LLC N.G.

In the case of voluntary repayment of debt for expired tax periods in the absence of a requirement to pay taxes (fees) from the tax authority (the value of the payment basis indicator is equal to ZD), a zero (0) is entered in field 109 of the payment order. In field 110 of the payment order, the payment type indicator is indicated: Tax - payment of a tax or fee.

Payment order for payment of penalties. When transferring penalties for late payment in relation to our example, the corresponding BCC should be indicated in the payment order, in field 106 “Base of payment” - TP, in field 107 “Tax period” - MS.01.2011, in field 108 and 109 zeros are entered, in field 110 “Payment type” - PE. Sample execution of a payment order Note that if the tax agent managed to correct the mistake made and withhold personal income tax in the full amount, he will only have to pay a penalty; he is exempt from the fine.

Info

But if an error in incorrect tax calculation had been found, say, in February 2018, then, accordingly, it would no longer be possible for the employer to withhold personal income tax. And in such a case, as a result of unlawful failure to withhold personal income tax based on the results of the expired tax period, the employer cannot avoid sanctions from the Federal Tax Service in the form of fines and penalties.

And the obligation to pay the unwithheld amount of personal income tax is transferred directly to the individual. In turn, the organization, as a tax agent, is required to submit to the Federal Tax Service a certificate 2-NDFL with attribute “2” for this employee - it will reflect information about unwithheld amounts of tax on the income of an individual for the tax period.

As for the collection of penalties for untimely withholding, there are two opinions - the Supreme Arbitration Court of the Russian Federation and the Federal Tax Service of the Russian Federation. Thus, the Supreme Arbitration Court of the Russian Federation in its resolution No. 57 of July 30, 2013

Thirdly, the amount of income to be paid is sufficient to withhold personal income tax. The ratio of the amount of accrued payments from which tax is withheld and the amount of tax is regulated by the Tax Code.

The amount of personal income tax should not exceed 50% of the payment amount (clause 4 of article 226 of the Tax Code of the Russian Federation). Fourthly, settlements between the tax agent and the individual for the tax period have not been completed, from whose income personal income tax should be withheld.

For example, wages accrued for December are paid in January of the following year. Until the day of its issuance, the tax agent has the opportunity to withhold personal income tax.

Later this opportunity is no longer available. This conclusion follows from the provisions of paragraphs 3 and 4 of Article 226 of the Tax Code. If the circumstances are different - at least one of the four conditions listed above is not met, the tax agent is not able to withhold personal income tax from the taxpayer’s income.

The basis for bringing to responsibility provided for in paragraph 1 of Art. 126.1 of the Code, will be the unreliability of information resulting from an arithmetic error, distortion of total indicators, other errors entailing adverse consequences for the budget in the form of non-calculation and (or) incomplete calculation, non-transfer of tax, violation of the rights of individuals (for example, rights to tax deductions ). However, according to paragraph 2 of Art. 126.1 of the Tax Code of the Russian Federation, a tax agent is exempt from liability under this article if he independently identifies errors and submits updated documents to the tax authority before the tax agent learns that the tax authority has discovered the unreliability of the information contained in the documents submitted to him.

In addition, the tax agent may be held liable under Art. 123 Tax Code of the Russian Federation. Furthermore, in accordance with Art. 126.1 of the Tax Code of the Russian Federation, the submission by a tax agent to the tax authority of documents provided for by the Tax Code of the Russian Federation, containing false information, entails a fine of 500 rubles.

for each submitted document containing false information. As stated in paragraph 3 of the Letter of the Federal Tax Service of Russia dated 08/09/2016 N GD-4-11/14515, in this regard, any completed details of information in form 2-NDFL and calculations in form 6-NDFL that do not correspond to reality can be classified as unreliable . In relation to the mentioned documents, these may be any errors made by the tax agent when filling out the relevant details (for example, in the taxpayer’s personal data, income and deduction codes, amounts, etc.).

Withheld and calculated personal income tax is a common concept for entrepreneurs and enterprises that hire employees. According to Art. 226 of the Tax Code of the Russian Federation, the responsibility of organizations and individual entrepreneurs includes the withholding and calculation of income tax.

The tax calculated and withheld in personal income tax have certain differences. Calculated tax is the calculated amount of personal income tax, which is subsequently withheld from the employee’s salary and sent to the country’s budget. The calculated personal income tax is reflected in certificate 2-NDFL.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

Withheld is the tax that remains with the employer before being transferred to the state budget. This type of tax is also reflected in the column “Withheld tax amount”.

Generally accepted procedure

The calculation of withholding and transfer of tax is as follows:

- Calculation of tax on all income (at the end of the month).

- Withholding of the calculated tax during the payment of income upon the fact.

- Conducting tax remittances of both types while receiving funds from the bank to pay income to employees.

According to this procedure, it turns out that the employer can only withhold the calculated tax, and only the withheld personal income tax can be transferred. Accordingly, it is impossible to both transfer the unwithheld tax and withhold the uncalculated tax.

Let's look at the order in more detail. The first stage is tax calculation. It is carried out based on the results of the reporting period, usually at the end of each month, and also on the basis of all income that the employee receives during the reporting period. Accordingly, in order to calculate the tax, it is necessary to understand exactly what income the employee received for the month. The tax calculation date usually coincides with the last day of the month.

Then the calculated tax must be withheld. This is done during the first payment of income. When the bank receives funds to pay workers’ salaries, the employer at the same time pays tax, which goes to the state budget.

It turns out that there cannot be tax transfers on income in the current month during the same month. For this type of payment, the tax is transferred no later than the last day of the month.

What are the characteristics of the tax calculated and withheld in personal income tax?

So, the calculated tax can be found out by multiplying the amount of personal income tax that was calculated earlier by the tax rate. When making calculations, you should pay attention to the fact that the profit received may be less by the amount of taxes deducted. The calculated personal income tax is entered in the field numbered “040”, respectively, tax deductions are recorded in line “030”, and accrued income is reflected in line “020”.

It turns out that the calculated tax is calculated using the following formula:

“040” = (“020” – “030”) * CH, where CH is the tax rate

Withheld personal income tax is the amount of tax that is necessarily withheld from the salaries and other income of employees. What is important here is that the very fact of deduction is made on the basis of the amounts of income that were actually received. It turns out that the employer undertakes, when making income payments to employees, to send the amount of taxes by payment order to the state budget.

The withheld tax is entered in field “070” in the certificate. It is worth considering that the size is indicated in this case on an accrual basis, and is reflected from the beginning of the year.

If the employee receives income in the form of material benefits, as well as in kind, personal income tax cannot be withheld. However, it must still be calculated from other types of financial orders.

According to Art. 226 of the Tax Code of the Russian Federation, the amount of tax withheld cannot be higher than half of the income received, calculated in money. And line “070” should reflect the amount of payments that were made precisely at the time the accountant compiled the report.

Main clarifications

Tax calculations should be carried out without taking into account the income that the taxpayer receives from other agents, as well as those funds that were withheld by third-party agents. They, in turn, must withhold the accrued tax when paying salaries of payers.

The deduction must be made by the employer himself. The amount withheld does not exceed 50% of all income.

If withholding is impossible, the agent must, within a month from the end of the tax period in which limiting circumstances may have arisen, inform the payer and the Federal Tax Service in writing about this fact. In this case, the tax amount must be reflected.

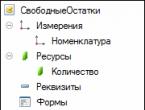

Differences in 1C ZUP

Both types of taxes differ in the accounting program by the type of movement in the accumulation register, called “NDFL settlements with the budget.” Calculated personal income tax is displayed in the “+” register, withheld – in “-”.

The “+” register contains reports on the calculation of dividends and salaries; the “-” register contains cash settlement documents and bank statements. At the same time, in the accounting parameters in the line “Payroll calculation” there should not be a checkmark opposite the line for accepting the calculated tax when it is calculated as withheld.

In this case, when posting the documents “Accrual” and “Salary accrual”, two entries will appear in the register - in “+” and “-”. The tax amounts will be the same.

The tax calculated and withheld in personal income tax can be different in many cases. For example, if an employee had a rolling vacation from December to January.

In this case, part of the vacation in December will be included in the calculated personal income tax, but the entire tax will be included in the withholding tax. In addition, if the amount of calculated tax exceeds 50% of income, the withheld tax will also differ from the calculated one - it will be less.

The essence of the differences

Federal Tax Service employees assure that differences in the amounts of withheld and calculated taxes can only arise if the calculations were previously made incorrectly. For this reason, if the 2-NDFL certificate reflects differences, then it is necessary for the employer to provide an explanatory receipt to the Federal Tax Service, which will confirm the accuracy of the calculations.

When drawing up an explanatory note, the accountant has the opportunity to once again check the accuracy of his calculations and identify inaccuracies in the report. If an error is identified, you must also provide the Federal Tax Service with a copy of the payment order, which should reflect the amount of tax that was erroneously not transferred.

If the tax is not paid within the allotted period or is not done at all, the employer will be forced to pay a fine of 20% of the total deduction.

Accounting Features

According to Article 226 of the Tax Code of the Russian Federation, the employee’s accrued tax must be withheld from any money that is paid to him, and this must be done precisely at the time of receipt of this finance. But the Code does not explain what exactly should be considered under the concept of “payment amount”.

1C methodologists propose the following formulation of this term - money that is either paid through cash registers into the hands of the employee, transferred to his bank account. Therefore, the amount of tax withheld physically cannot exceed the total amount of money that was received by him during the reporting period. However, this interpretation of the term can be adjusted.

In the standard configuration, money that is transferred to the employee’s bank account or issued through a cash register must be recorded by the “Payment of salaries” entry. If funds are transferred to the accounts of third parties at the request of the employee, then such finances are registered as “Transfer of salary to the bank.”

The withholding tax is calculated after the money is paid to the employee. For this purpose, the standard configuration provides a special mode to perform a group calculation of the salary.

If there may be delays in wages at the enterprise, and in some of the reporting periods the employees did not receive money, then the enterprise, as a tax agent, does not have the right to withhold the calculated tax from its employees. Accordingly, records for withheld taxes will be zero. When repaying the debt in the next reporting period, the company will withhold the calculated tax for both months.

Caveats about meanings

It is also possible that situations may arise when the calculated tax turns out to be less than the withheld tax and vice versa. Such situations are quite acceptable even if taxes are calculated correctly, therefore, such cases should not be considered erroneous. Let's figure out why such situations may arise.

Less

If the withheld tax is less than calculated, you need to check it in the settings program. First, you should carefully study the tax card (1-NDFL). Here you need to find the first month out of all 12 in which the first discrepancy between the types of taxes occurred.

After this, you should go to the “Personal Income Tax Payments with the Budget” register, classify the entries by a specific employee for the entire reporting year and check the movements in such a register in the first month where discrepancies were recorded. You need to look at the “+” and “-” movements.

After this, the employee’s payment documents for the same month must be checked in the “Settlements with the Budget” register. It is necessary to identify the absence and presence of records on payment documents.

Here the problem could well arise as a result of changing the position of the checkbox to accept the calculated tax as withheld when calculating the tax. This can be seen in the accounting settings.