Inventory control. Warehouse accounting Keeping records in the 1c warehouse program

1C: Accounting 8.2. A clear tutorial for beginners Gladky Alexey Anatolyevich

Chapter 10. Accounting for warehouse operations

Warehouse accounting is mandatory at any enterprise. After all, even those business entities that are not engaged in trade, construction or production (that is, activities whose very specificity implies the presence of warehouses with a large assortment of valuables), in any case have some assets on their balance sheet (stationery, furniture, office equipment, spare parts) parts, etc.), which, in accordance with accounting requirements, must be carried through the warehouse.

In this chapter we will learn how to maintain inventory records using the 1C Accounting 8 program.

From the book Accounting Theory: Lecture Notes author Daraeva Yulia Anatolevna6. Accounting for cash transactions Cash transactions are operations associated with the receipt, storage and expenditure of various funds received by the organization’s cash desk from the servicing bank. Receipt of funds to the cash desk from the current account in the accounting

From the book Accounting author Melnikov Ilya3. Accounting for trust management operations. Accounting for property transferred to trust management An enterprise can transfer its property for a certain period of time for management to another enterprise (person), which will manage this property

From the book Accounting in Insurance author Krasova Olga SergeevnaChapter 8 ACCOUNTING FOR CASH AND SETTLEMENT OPERATIONS SETTLEMENTS OF THE ENTERPRISE The economic activities of an enterprise cannot be carried out without various calculations inside and outside the organization. Internal settlements are, for example, settlements with personnel for wages, with

From the book Accounting in Trade author Sosnauskiene Olga IvanovnaACCOUNTING FOR CASH OPERATIONS IN FOREIGN CURRENCY AND OPERATIONS ON A CURRENCY ACCOUNT To account for transactions in foreign currency, a special cash desk will be created, and an agreement on full individual financial responsibility will be concluded with the currency cashier. Cash registers must be provided with all instructions,

From the book Accounting for Securities and Currency Transactions author Sosnauskiene Olga IvanovnaChapter 4. Accounting for transactions under voluntary agreements

From the book Accounting author Bortnik Nikolai NikolaevichChapter 5. Accounting for mandatory transactions

From the book Theory of Accounting. Cheat sheets author Olshevskaya NatalyaChapter 2. Accounting for trade operations

From the book Logistics author Savenkova Tatyana IvanovnaChapter 3 ACCOUNTING OF TRANSACTIONS WITH VALUABLES

From the book Margingame author Ponomarev IgorChapter 6 Accounting for business transactions

From the book 1C: Managing a small company 8.2 from scratch. 100 lessons for beginners author Gladky Alexey Anatolievich115. Accounting for VAT transactions To reflect business transactions related to VAT in accounting, active account 19 “Value added tax on acquired assets” and passive account 68 “Calculations for taxes and fees” are used. Account 19 has the following

From the book New procedure for calculating and paying sick leave author Sergeeva Tatyana Yurievna7. 5. Features of warehouse operations in wholesale warehouses The list of services performed by different warehouses differs from each other, and the complexes of warehouse operations performed will accordingly be different. A range of warehousing services performed in warehouses

From the book ABC of Accounting author Vinogradov Alexey YurievichAccounting for financial transactions 1. At the beginning of the game, each player registers financial assets by filling out the “owner” column, entering his name - Ivan Ivanovich Ivanov. For a group game, the team name is written in the column. The number of assets for each player depends on

From the author's bookChapter 3 Accounting for supply and purchasing operations The purchase of goods, raw materials and supplies, as well as the purchase of services is one of the key activities of any modern enterprise. In this chapter we will learn how to design all the most popular

From the author's bookChapter 9. Accounting for transactions for the accrual and payment of temporary disability benefits The accrual of maternity benefits is reflected in accounting in accordance with the Chart of Accounts for accounting financial and economic activities

From the author's bookChapter 5. Accounting for personnel transactions 5.1. General information on payroll calculation The basis for calculating the earnings of workers and employees, as a rule, is a 5-day (40-hour) working week. There are 2 forms of remuneration - 1) time-based (based on hours worked

From the author's bookChapter 10. Accounting for settlement transactions 10.1. Settlements with buyers and customers To account for settlements with buyers and customers, account 62 “Settlements with buyers and customers” is used. The debit of account 62 takes into account the debt of buyers, and the credit of account

Accounting parameters are infobase settings that determine the order of accounting. In the release "1C: Accounting 8.3" 3.0.43.162 and in later releases, the main part of the accounting parameters is configured through special forms "Setting up a chart of accounts" and "", available from the corresponding sections.

In addition, there is a combined form of accounting parameters, which opens through “Administration” – Program Settings – Accounting Parameters. It also configures the printing of articles and the terms of payment from buyers and payments to suppliers.

(also available through the “Main” section – Chart of Accounts –). Enables or disables the use of subconto, i.e. analytical sections of accounting on accounting accounts. The names of the links indicate the current settings; to change, you must click the link. Here you can select the following options.

Accounting for VAT amounts on purchased assets

Get 267 video lessons on 1C for free:

Accounting for settlements with personnel

You need to choose the required accounting method - consolidated or for each employee. This setting controls the subaccount on accounts 70, 76.04, 97.01.

Cost accounting

You can choose how to account for costs – by department or across the entire organization. In this case, subaccounts are set up on accounting accounts 20, 23, 25, 26.

Salary settings

(also available in the “Salaries and Personnel” section – Directories and settings –). The following parameters can be configured here.

General settings

It is necessary to choose in which program the organization takes into account personnel and payroll calculations - in this or in an external one.

In this form indicate the following:

- on the “Salary” tab – select the method of reflecting salaries in accounting; salary payment date; method of accounting for written-off amounts by depositors; data for the FSS pilot project;

- on the “Taxes and Payroll Contributions” tab – indicate the type of contribution rate for compulsory insurance (set by default; in the case of a “special” rate, the desired one is selected); parameters for calculating additional contributions; the size of the contribution rate for insurance from NS and PZ; method of applying standard deductions for personal income tax;

- on the “Vacation Reserves” tab – a note about the formation of a vacation reserve (if necessary) and the method for reflecting them in accounting;

- on the Territorial conditions tab - if applicable, indicate the northern allowance, regional coefficient, data on work in special local conditions.

Salary calculation. In the absence of organizations with more than 60 employees, the program supports, which is enabled using the appropriate flag. Also here you can set up automatic recalculation of the document “” and go to the “Accruals” and “Deductions” directories to view or fill out.

Reflection in accounting. Here you can follow the links to the reference books “Methods of accounting for salaries” and “Cost items for insurance premiums” for setting up salary accounting and.

Personnel accounting. The program allows you to choose methods of personnel records - full (with the generation of all personnel documents in the program) or simplified (without personnel documents, orders are printed from the employee’s form).

Classifiers. Here you can find the parameters for calculating insurance premiums (types of income, tariffs, discounts, maximum base value) and types of income and deductions for personal income tax.

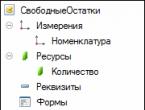

Maintained on subaccounts subordinate to account 10 “Materials”. They have a “Nomenclature” sub-account, and for most of these accounts it is also possible to include a “Parts” and “Warehouses” sub-account. In the context of subconto, analytical accounting is carried out:

Then accounting accounts will be automatically established in the documents in accordance with the accounting rules for materials (item accounting accounts are available from the “Nomenclature” directory):

Receipt of materials is reflected in the standard document "". The document is available in the “Purchase” section. When receiving materials, as well as when goods arrive at the enterprise, you should select the document type “Goods (invoice)” or “Goods, services, commission” (in the latter case, the materials are entered on the “Goods” tab).

The accounting account is set automatically if the “Materials” type was specified for the item, or they are selected manually:

Get 267 video lessons on 1C for free:

The document makes accounting entries in Dt account 10, and also, for an organization that is a VAT payer, in Dt 19.03 (“VAT on purchased inventories”). Printing of a receipt warehouse order (M-4) is available.

How to register the receipt of materials in 1C, see our video:

Write-off of materials for production

The transfer of materials and raw materials into production and their write-off as costs is reflected in the document “”, available in the “Production” or “Warehouse” sections. On the “Materials” tab, you need to indicate the materials, their quantity, and the accounting account (the latter can be filled out automatically or manually). The cost of materials when written off is calculated during document posting according to (FIFO or average cost):

On the “Cost Account” tab, you need to select the account to which the materials are written off and its analytics (sub-account):

If materials must be written off to different accounts or in different analytical sections (cost items, departments, etc.), you need to check the box “Cost accounts on the Materials tab” and indicate the write-off parameters on this tab in the columns that appear in the tabular section.

The “Customer Materials” tab serves only to reflect processing.

The document makes postings on Kt account 10 in Dt of the selected cost account. Printing of the demand invoice form M-11 and a non-unified form is available.

Watch our video on writing off materials in 1C using stationery as an example:

Sales of materials

It is registered with the standard document “Sales (acts, invoices)”, which is available in the “Sales” section. As with the sale of goods, you must select the document type “Goods (invoice)” or “Goods, services, commission” (then the materials are entered on the “Goods” tab).

Sales of materials should be accounted for in accounting on account 91 “Other income and expenses”: revenue is reflected in the credit of subaccount 91.01 “Other income”, and expenses (cost of materials, VAT) are reflected in the debit of subaccount 91.02 “Other expenses”. If the “Materials” type was specified for the item, accounting accounts are installed in the document automatically.

But the subconto of account 91.01 - the item of income and expenses - is not filled in, as evidenced by the “empty space” in the “Accounts” column. You should click the link in this column and in the window that opens, manually select the item of other income and expenses (if necessary, add a new item, indicating the type of item “Sale of other property”):

Privacy agreement

and processing of personal data

1. General Provisions

1.1. This agreement on confidentiality and processing of personal data (hereinafter referred to as the Agreement) was accepted freely and of its own free will, and applies to all information that Insales Rus LLC and/or its affiliates, including all persons included in the same group with LLC "Insails Rus" (including LLC "EKAM Service") can obtain information about the User while using any of the sites, services, services, computer programs, products or services of LLC "Insails Rus" (hereinafter referred to as the Services) and in during the execution of Insales Rus LLC any agreements and contracts with the User. The User's consent to the Agreement, expressed by him within the framework of relations with one of the listed persons, applies to all other listed persons.

1.2.Use of the Services means the User agrees with this Agreement and the terms and conditions specified therein; in case of disagreement with these terms, the User must refrain from using the Services.

"Insales"- Limited Liability Company "Insails Rus", OGRN 1117746506514, INN 7714843760, KPP 771401001, registered at the address: 125319, Moscow, Akademika Ilyushina St., 4, building 1, office 11 (hereinafter referred to as "Insails" ), on the one hand, and

"User" -

or an individual who has legal capacity and is recognized as a participant in civil legal relations in accordance with the legislation of the Russian Federation;

or a legal entity registered in accordance with the laws of the state of which such person is a resident;

or an individual entrepreneur registered in accordance with the laws of the state of which such a person is a resident;

which has accepted the terms of this Agreement.

1.4. For the purposes of this Agreement, the Parties have determined that confidential information is information of any nature (production, technical, economic, organizational and others), including the results of intellectual activity, as well as information about the methods of carrying out professional activities (including, but not limited to: information about products, works and services; information about technologies and research activities; data about technical systems and equipment, including software elements; business forecasts and information about proposed purchases; requirements and specifications of specific partners and potential partners; information, related to intellectual property, as well as plans and technologies related to all of the above) communicated by one party to the other in written and/or electronic form, expressly designated by the Party as its confidential information.

1.5. The purpose of this Agreement is to protect confidential information that the Parties will exchange during negotiations, concluding contracts and fulfilling obligations, as well as any other interaction (including, but not limited to, consulting, requesting and providing information, and performing other instructions).

2. Responsibilities of the Parties

2.1. The Parties agree to keep secret all confidential information received by one Party from the other Party during the interaction of the Parties, not to disclose, divulge, make public or otherwise provide such information to any third party without the prior written permission of the other Party, with the exception of cases specified in the current legislation, when the provision of such information is the responsibility of the Parties.

2.2.Each Party will take all necessary measures to protect confidential information using at least the same measures that the Party uses to protect its own confidential information. Access to confidential information is provided only to those employees of each Party who reasonably need it to perform their official duties under this Agreement.

2.3. The obligation to keep confidential information secret is valid within the validity period of this Agreement, the license agreement for computer programs dated December 1, 2016, the agreement to join the license agreement for computer programs, agency and other agreements and for five years after termination their actions, unless otherwise separately agreed by the Parties.

(a) if the information provided has become publicly available without a violation of the obligations of one of the Parties;

(b) if the information provided became known to a Party as a result of its own research, systematic observations or other activities carried out without the use of confidential information received from the other Party;

(c) if the information provided is lawfully received from a third party without an obligation to keep it secret until it is provided by one of the Parties;

(d) if the information is provided at the written request of a government agency, other government agency, or local government body in order to perform their functions and its disclosure to these bodies is mandatory for the Party. In this case, the Party must immediately notify the other Party of the received request;

(e) if the information is provided to a third party with the consent of the Party about which the information is transferred.

2.5.Insales does not verify the accuracy of the information provided by the User and does not have the ability to assess his legal capacity.

2.6. The information that the User provides to Insales when registering in the Services is not personal data, as defined in Federal Law of the Russian Federation No. 152-FZ of July 27, 2006. “About personal data.”

2.7.Insales has the right to make changes to this Agreement. When changes are made to the current edition, the date of the last update is indicated. The new version of the Agreement comes into force from the moment it is posted, unless otherwise provided by the new version of the Agreement.

2.8. By accepting this Agreement, the User understands and agrees that Insales may send the User personalized messages and information (including, but not limited to) to improve the quality of the Services, to develop new products, to create and send personal offers to the User, to inform the User about changes in Tariff plans and updates, to send the User marketing materials on the subject of the Services, to protect the Services and Users and for other purposes.

The user has the right to refuse to receive the above information by notifying in writing to the email address Insales -.

2.9. By accepting this Agreement, the User understands and agrees that Insales Services may use cookies, counters, and other technologies to ensure the functionality of the Services in general or their individual functions in particular, and the User has no claims against Insales in connection with this.

2.10. The user understands that the equipment and software used by him to visit sites on the Internet may have the function of prohibiting operations with cookies (for any sites or for certain sites), as well as deleting previously received cookies.

Insales has the right to establish that the provision of a certain Service is possible only on the condition that the acceptance and receipt of cookies is permitted by the User.

2.11. The user is independently responsible for the security of the means he has chosen to access his account, and also independently ensures their confidentiality. The User is solely responsible for all actions (as well as their consequences) within or using the Services under the User’s account, including cases of voluntary transfer by the User of data to access the User’s account to third parties under any conditions (including under contracts or agreements) . In this case, all actions within or using the Services under the User’s account are considered to be carried out by the User himself, except in cases where the User notified Insales of unauthorized access to the Services using the User’s account and/or of any violation (suspicion of violation) of the confidentiality of his means of accessing your account.

2.12. The User is obliged to immediately notify Insales of any case of unauthorized (not authorized by the User) access to the Services using the User’s account and/or of any violation (suspicion of violation) of the confidentiality of their means of access to the account. For security purposes, the User is obliged to independently safely shut down work under his account at the end of each session of working with the Services. Insales is not responsible for possible loss or damage to data, as well as other consequences of any nature that may occur due to the User’s violation of the provisions of this part of the Agreement.

3. Responsibility of the Parties

3.1. The Party that has violated the obligations stipulated by the Agreement regarding the protection of confidential information transferred under the Agreement is obliged, at the request of the injured Party, to compensate for the actual damage caused by such violation of the terms of the Agreement in accordance with the current legislation of the Russian Federation.

3.2. Compensation for damage does not terminate the obligations of the violating Party to properly fulfill its obligations under the Agreement.

4.Other provisions

4.1. All notices, requests, demands and other correspondence under this Agreement, including those including confidential information, must be in writing and delivered personally or via courier, or sent by email to the addresses specified in the license agreement for computer programs dated 12/01/2016, the agreement of accession to the license agreement for computer programs and in this Agreement or other addresses that may subsequently be specified in writing by the Party.

4.2. If one or more provisions (conditions) of this Agreement are or become invalid, then this cannot serve as a reason for termination of the other provisions (conditions).

4.3. This Agreement and the relationship between the User and Insales arising in connection with the application of the Agreement are subject to the law of the Russian Federation.

4.3. The User has the right to send all suggestions or questions regarding this Agreement to the Insales User Support Service or to the postal address: 107078, Moscow, st. Novoryazanskaya, 18, building 11-12 BC “Stendhal” LLC “Insales Rus”.

Publication date: 12/01/2016

Full name in Russian:

Limited Liability Company "Insales Rus"

Abbreviated name in Russian:

LLC "Insales Rus"

Name in English:

InSales Rus Limited Liability Company (InSales Rus LLC)

Legal address:

125319, Moscow, st. Akademika Ilyushina, 4, building 1, office 11

Mailing address:

107078, Moscow, st. Novoryazanskaya, 18, building 11-12, BC “Stendhal”

INN: 7714843760 Checkpoint: 771401001

Bank details: